Stock Markets

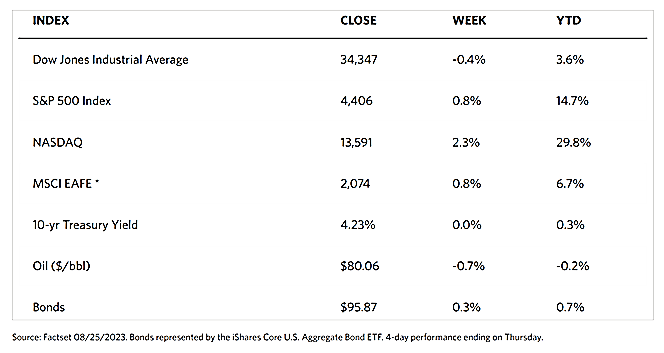

The Dow Jones Industrial Average (DJIA) moved marginally lower this week by 0.45% although the DJ Total Stock Market inched higher by 0.72%. The broad S&P 500 Index also gained by 0.82% with small caps losing ground and midcaps gaining. The technology-heavy Nasdaq Stock Market Composite surged by 2.26% while the NYSE Composite moved up by 0.11% and the Russell 1000 by 0.79%. The CBOE Volatility Index, which tracks investor risk perception, declined by 9.36%, according to data from the WSJ Markets.

The Federal Reserve’s pronouncement in this week’s annual Jackson Hole symposium about future interest rate hikes remained hawkish but was noticeably more balanced than last year. This was seen as catering favorably for equities and bonds, although uncertainty remains concerning what policy measures are still needed to deal with the higher-than-target inflation readings. Powell conveyed that the Fed remains committed to defeating inflation even though it may cause “some pain” for U.S. households. His message was somewhat more nuanced, however, emphasizing that future Fed decisions will be based on the data, indicating that the policy-making body is keeping its options open. The Fed’s mixed signals muted trading for the week.

Growth stocks outperformed value shares this week as investors responded to substantial earnings and revenue reports by artificial intelligence chipmaker NVIDIA. Earlier in the week, financials pulled back after S&P Global downgraded its credit rating of five regional banks. The downgrade was, in part, due to stresses in the commercial real estate lending market. A generally cautious picture regarding the health of the U.S., consumer market was painted by second-quarter results reported by some retailers. Department store operator Macy’s shares fell sharply as a result of reporting a drop in earnings and warned of growing consumer caution coupled with rising credit card delinquencies. Nordstrom, Macy’s competitor, also reported rising late payments on its credit cards in issuing a cautious outlook, although their realized earnings and revenues beat estimates. Nordstrom, specialty retailer Dick’s Sporting Goods, and discount chain Dollar Tree all noted that earnings suffered due to exceptionally high levels of theft from their stores.

U.S. Economy

According to the Fed, economic growth remains more resilient even by their own expectations, although some downside is still expected in reaction to the impact of past, and possibly future, rate hikes through the economy. Policy rates are likely nearing or at their peak. In the meantime, the durable goods orders data released on Thursday indicated that a somewhat higher degree of business caution was prevalent in some areas. Durable goods orders excluding defense and transportation, a commonly accepted proxy for business investment, rose by 0.1% in July although it was more than offset by a downwardly revised 0.4% contraction in June. S&P Global’s index of manufacturing activity also fell more than expected in August. This indicator reversed most of July’s strong gain and moved further back into contraction territory.

Despite the highest mortgage rates in years, the housing sector appeared more robust with new home sales ascending to their highest level in July since early 2022. On Thursday, Freddie Mac reported that the 30-year fixed rate mortgage had reached its highest level since 2001. However, existing home sales declined and missed expectations. In the Jackson Hole, Wyoming Fed symposium, Powell admitted that the higher rates had slowed growth in wages and industrial production even as tightening bank lending standards were colling the economy. He noted that economic growth, on the other hand, remained above its longer-term trend. Furthermore, the housing sector also appeared to be regaining momentum after slowing sharply over the past one and a half years.

Metals and Mining

Despite the many challenges that faced the gold market, prices refuse to go lower, possibly indicating that strong support exists at current levels. Among the challenges was the increase in 10-year bond yields to its highest in 15 years. Higher bond yields traditionally bode ill for gold prices because they raise the opportunity cost of precious metals, a nonyielding asset. This week the gold market did see some initial weakness, but this was quickly dispelled as prices were looking to start the weekend with a 1% gain, ending four weeks of losses. Simultaneously, silver is ending the week up as it saw a modest short squeeze. Despite its current strength, however, it is unlikely that gold has the momentum to rally back to $2,000 per ounce anytime soon, with the Fed’s prevailing policy addressing stubborn inflation and a relatively tight labor market.

This week, the spot prices of precious metals ended mixed. Gold closed the week at $1,914.96 per troy ounce, up by 1.36% from last week’s close at $1,889.31. Silver ended at $24.23 per troy ounce, higher by 6.51% from the previous week’s close at $22.75. Platinum ended the week at $948.43 per troy ounce, higher by 3.70% from the previous week’s close at $914.58. Palladium bucked the trend to close at $1,227.74 per troy ounce, down by 2.37% from the earlier week’s close at $1,257.57. The three-month LME prices of industrial metals were generally up. Copper, which closed at $8,235.50 last week, rose by 1.51% to close at $8,359.50 per metric ton. Zinc, which ended one week ago at $2,298.00, closed this week at $2,394.00 per metric ton for a gain of 4.18%. Aluminum, which last traded at $2,145.50 last week, closed this week at $2,157.50 per metric ton for a gain of 0.56%. Tin gained 2.23% from the previous week’s close at $25,305.00 to this week’s close at $25,870.00 per metric ton.

Energy and Oil

Oil prices this week were weighed heavily down by rumors of a US-Venezuela rapprochement and the prospect of Kurdish oil exports returning to the market. However, some of the downward pressure was counter-balanced by healthy U.S. crude inventory draws and lower-than-expected product stock levels in Europe. The U.S. Federal Reserve’s Jackson Hole meeting this week also failed to surprise in either direction; therefore, in the absence of any major turns, oil prices ended the week sideways with another very minor weekly loss.

Natural Gas

In the first six months of 2023, the U.S. exported more liquefied natural gas (LNG) than any other LNG-exporting country in the world, according to data from CEDIGAZ. the increase in LNG exports from the U.S. was mostly due to Freeport LNG’s return to service and continued growth in global LNG demand, particularly in Europe. Following the U.S. was Australia as the world’s second-largest exporter. The European Union (EU 27 plus the UK) reprised its 2022 position as the main destination for U.S. LNG in the first half of 2023, accounting for 67% of total U.S. exports which increased by 14% over the 2022 annual average. The Netherlands, the U.K., France, Spain, and Germany accounted for 77% of total U.S. LNG exports to Europe.

For this report week from August 16 to August 23, 2023, the Henry Hub spot price rose by $0.04, from $2.55 per million British thermal units (MMBtu) to $2.59/MMBtu. The price of the September 2023 NYMEX contract decreased by $0.095 from $2.592/MMBtu at the start of the week to $2.497/MMBtu at the end of the week. The price of the 12-month strip averaging September 2023 to August 2024 futures contracts descended by $0.115 to $3.224/MMBtu.

International natural gas futures prices increased for this report week. The weekly average front-month future prices for LNG cargoes in East Asia increased by $2.33 to a weekly average of $14.09/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.60 to a weekly average of $12.35/MMBtu. In the week in 2022 that corresponded to this week (August 17 to August 24, 2022), the prices were $59.01/MMBtu in East Asia and $77.60/MMBtu at the TTF.

World Market

In Europe, there was some optimistic macroeconomic news that incentivized investors to push stock prices higher. The pan-European STOXX Europe 600 Index inched up by 0.66% as expectations grew that interest rates may soon peak and European natural gas prices dropped. The major stock indexes in the region generally ended higher. Italy’s FTSE MIB advanced by 1.61%, France’s CAC 40 Index ascended by 0.91%, and Germany’s DAX climbed by 0.37%. The UK’s FTSE 100 Index gained by 1.05%. Eurozone bond yields declined and the 10-year German sovereign yields closed lower. Economic data indicated that the European economy was weakening, leading to growing expectations in the financial markets that future interest rates would not increase much further.

Japanese stocks rose this week as the market rallied from the declines of the previous week to chalk up four consecutive days of gains before giving up much of the gains in Friday’s trading. The broad TOPIX ended up 1.3% while the benchmark Nikkei 225 closed the week higher by 0.6%. Japanese investors appeared unaffected by a softer-than-hoped-for policy response from China to address their slowing growth and a building property crunch. Encouraging domestic data announcements further buoyed the markets. Both manufacturing and services sector activity combined to bring flash composite PMI data to increase to 52.6 in August, up from 52.2 in July. While Japan’s factory activity declined for a third consecutive month in August, the data shows that the rate of decline was decelerating. A 3.1% rise in Japan’s core consumer prices in July was generally well received although various inflation readings during the week provided mixed messages. The yen continued to weaken against the dollar, a trend that prevailed over recent months. This week it finished in the low JPY 146 range against the U.S. dollar, which is close to levels reached in September-October 2022, prompting intervention from the Bank of Japan.

Chinese stocks ended lower for the week in line with growing investor pessimism about the country’s economic outlook. The Shanghai Composite Index as well as the blue-chip CSI 300 Index both suffered weekly declines, adding to their year-to-date losses. The Shanghai Composite Index is at its lowest level since December of last year, while the CSI 300 Index is trading at its lowest level since November 2022. The Hang Seng Index, Hong Kong’s benchmark which entered a bear market Friday of the preceding week, retraced to end up marginally higher for the week, although it also is at its lowest level since November. Several factors contributed to an erosion of confidence in China’s economy, among which are disappointing domestic economic data, signs of deflation, record youth unemployment, and continued liquidity problems in the debt-laden property sector. The specter of accelerated capital outflows is being raised by signs of deteriorating growth and a sense that Beijing has relatively few good options to arrest the downturn. Over the 13 trading days through Wednesday, overseas funds sold the equivalent of US $10.7 billion from the mainland market. However, the risks of a systemic crisis emanating from China’s property sector appear low.

The Week Ahead

Among the important economic data scheduled for release this week are the July PCE inflation report, the August unemployment rate, and nominal personal income and spending.

Key Topics to Watch

- S&P Case-Shiller home price index (20 cities)

- Job openings

- Consumer confidence

- ADP employment

- GDP (revision)

- Advanced U.S. trade balance in goods

- Advanced retail inventories

- Advanced wholesale inventories

- Pending home sales

- Initial jobless claims

- Personal income (nominal)

- Personal spending (nominal)

- PCE index

- Core PCE index

- PCE (year-over-year)

- Core PCE (year-over-year)

- Chicago Business Barometer

- U.S. nonfarm payrolls

- U.S. unemployment rate

- U.S. hourly wages

- Hourly wages year-over-year

- ISM manufacturing

- Construction spending

Markets Index Wrap Up