Oversea-Chinese Banking Corporation (OCBC) is letting consumers in Singapore conduct cross-border transactions through an Alipay+ integration.

An Influx in Cross-Border Transactions

Via the OCBC app, consumers in Singapore are now able to scan and pay at Alipay+ merchants in Malaysia and South Korea. And as of Sept. 22, the service will be available to consumers in Mainland China.

According to OCBC, the timing of its expansion “coincides with the start of the 19th Asian Games in Hangzhou, and when travel to and from Mainland China is expected to ramp up, especially given the recent resumption of the 15-day visa-free entry for Singaporeans and the Chinese government’s elimination of the need for a pre-departure Covid-19 antigen test.”

As more consumers travel the globe, the ability to pay for goods and services via their preferred method is becoming ever more important. OCBC is seeing this shift and acting accordingly.

One notable feature of its integration with Alipay+ is that payments are made directly from the customer’s OCBC Singapore bank account versus having to deal with any third-party apps.

Rapid Payment Transformation

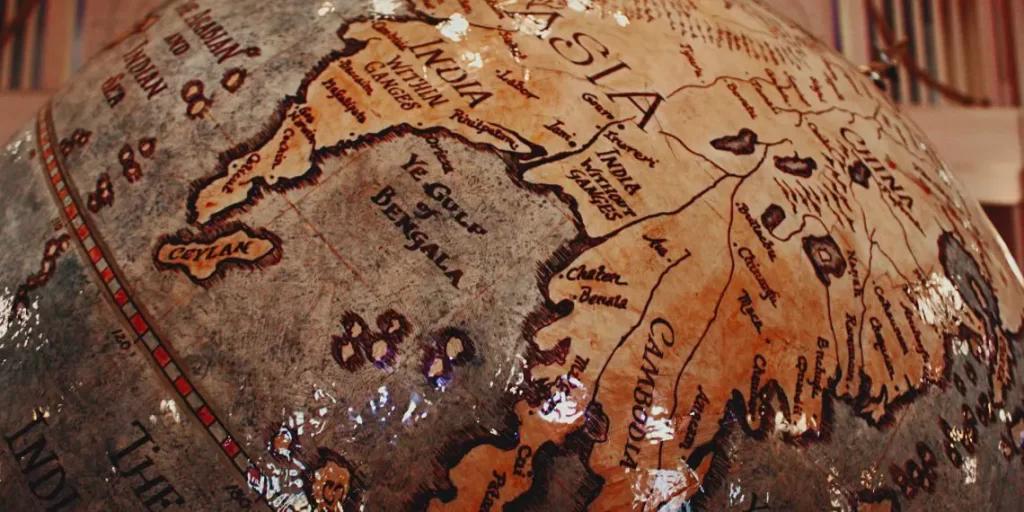

AsiaPac continues to lead the way in instant payments, and while these networks represent regional schemes, they offer an excellent model for how other regions of the world should look to expand, says Albert Bodine, Head of Commercial and Enterprise Payments at Javelin Strategy & Research.

“These regional schemes also are establishing a framework to follow for what will eventually become a global instant payments rail,” he said.

In the last year alone, OCBC has established cross-border payment linkages with Malaysia’s DuitNow QR and Thailand’s PromptPay QR, facilitating peer-to-merchant transactions. This demonstrates OCBC’s commitment to embracing fintech innovations and extending its reach across Asia. Future markets include Japan, Hong Kong, and Macao.

OCBC’s partnership with Alipay+ underscores the evolving landscape of fintech and cryptocurrency adoption in the region, where traditional banks are collaborating with digital innovators to offer customers a more efficient and convenient way to transact globally.