Expense management startup Navan has inked an exclusive deal with Citi that executives say will open its addressable market significantly.

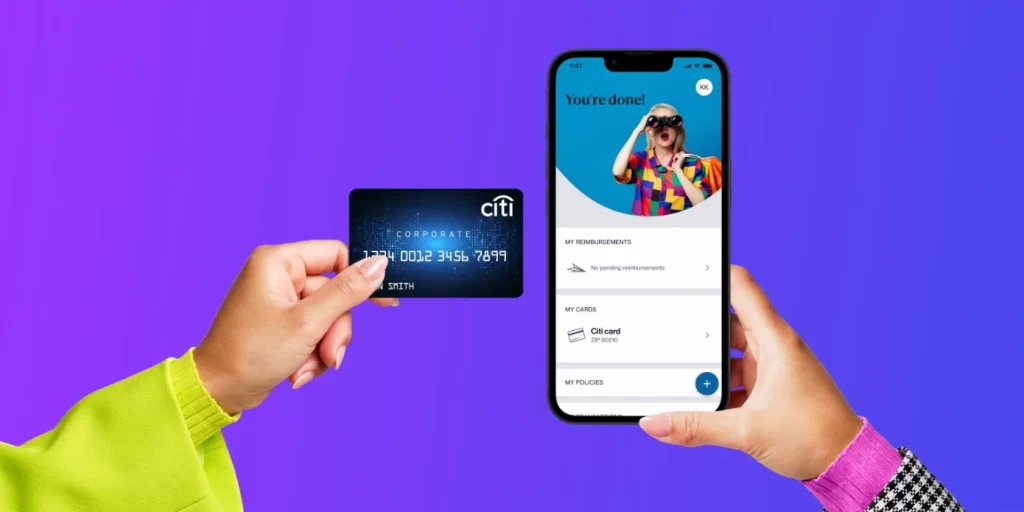

Specifically, the fintech and the card giant are announcing today a new, jointly branded travel and expense system designed for Citi Commercial (CCB) cardholders.

This is significant for Navan considering that Citi is the third largest bank in the U.S. and supports more than 25,000 global commercial card programs and 7 million cardholders globally. Those cardholders represent more than $42 billion in annual charge volume in the U.S. alone.

“This deal is increasing the addressable market and companies we can sell to,” said Michael Sindicich, executive vice president and GM of Navan Expense.

Citi will offer its commercial clients — defined as companies with annual revenue of $10 million or more — the ability to opt in to Navan’s offering, Navan Connect. Once opted in, the cardholders’ accounts will be integrated with Navan’s software and users will no longer have to file a report for travel-related or other expenses.

Chris Pieroth, managing director, head of commercial cards global product development at Citi, told TechCrunch in an interview that the bank’s clients “have been asking for this for a while.”

“They have said, ‘It would really be nice if you could offer us a true end-to-end solution that handles the booking, the payment and the expenses… We spent a long time considering different partners, and we settled on Navan for a variety of reasons — the biggest I think being that they’ve really taken an innovative approach to the travel and expense environment. And this concept of not having to file an expense report is like nirvana for most cardholders. We’ve been hearing that for decades.”

Before unveiling its Connect offering, Navan (formerly TripActions), customers would need to use its cards in order to have access to its automated expense management and payments capabilities.

But then the company realized the value of integrating its own technology with those of financial institutions. As such, Navan is not concerned with its Connect product competing with its own corporate card offering.

Rather than making money off of interchange fees, Navan is generating revenue through subscription license fees for its expense management software and for travel by charging trip fees.