As more and more Americans embrace electric vehicles, automakers and the federal government are racing to secure the materials needed to build EV batteries, including by pouring billions of dollars into battery recycling. Today, recyclers are focused on recovering valuable metals like nickel and cobalt from spent lithium-ion batteries. But with the trade war between the U.S. and China escalating, some are now taking a closer look at another battery mineral that today’s recycling processes treat as little more than waste.

On December 1, China implemented new export controls on graphite, the carbon-based mineral that’s best known for being used in pencils but that’s also used in a more refined form in commercial EV battery anodes. The new policies, which the Chinese government announced in October shortly after the Biden administration increased restrictions on exports of advanced semiconductors to China, have alarmed U.S. lawmakers and raised concerns that battery makers outside of China will face new challenges securing the materials needed for anodes. Today, China dominates every step of the battery anode supply chain, from graphite mining and synthetic graphite production to anode manufacturing.

Along with a new federal tax credit that rewards automakers that use minerals produced in America, China’s export controls are boosting the U.S. auto industry’s interest in domestically sourced graphite. But while it could take many years to set up new graphite mines and production facilities, there is another, potentially faster option: Harvesting graphite from dead batteries. As U.S. battery recyclers build big new facilities to recover costly battery metals, some are also trying to figure out how to recycle battery-grade graphite—something that isn’t done at scale anywhere in the world today due to technical and economic barriers. These companies are being aided by the U.S. Department of Energy, which is now pouring tens of millions of dollars into graphite recycling initiatives aimed at answering basic research questions and launching demonstration plants.

If the challenges holding back commercial graphite recycling can be overcome, “the used graphite stream could be huge,” Matt Keyser, who manages the electrochemical energy storage group at the the Department of Energy’s National Renewable Energy Laboratory, told Grist. In addition to boosting domestic supplies, recycling graphite would prevent critical battery resources from being wasted and could reduce the carbon emissions tied to battery production.

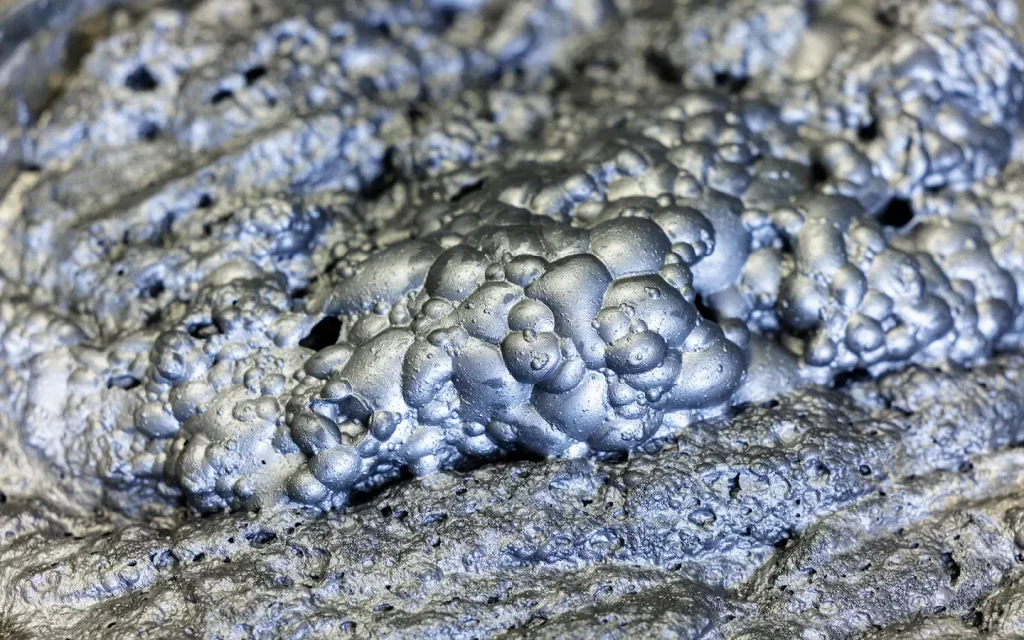

To understand why graphite is hard to recycle, a bit of material science is necessary. Graphite is a mineral form of carbon that has both metallic and non-metallic properties, including high electrical and thermal conductivity and chemical inertness. These qualities make it useful for a variety of energy and industrial applications, including storing energy inside lithium-ion batteries. While a lithium-ion battery is charging, lithium ions flow from the metallic cathode into the graphite anode, embedding themselves between crystalline layers of the carbon atoms. Those ions are released while the battery is in use, generating an electrical current.

Graphite can be found in nature as crystalline flakes or masses, which are mined and then processed to produce the small, spherical particles needed for anode manufacturing. Graphite is also produced synthetically by heating byproducts of coal or petroleum production to temperatures greater than 2,500 degrees Celsius (about 4,500 degrees Fahrenheit)—an energy-intensive (and often emissions-intensive) process that triggers “graphitization” of the carbon atoms.

Relatively cheap to mine or manufacture, graphite is lower in value than many of the metals inside battery cathodes, which can include lithium, nickel, cobalt, and manganese. Because of this, battery recyclers traditionally haven’t taken much interest in it. Instead, with many battery recyclers hailing from the metals refining business, they’ve focused on what they already knew how to do: extracting and purifying those cathode metals, often in their elemental form. Graphite, which can comprise up to 30 percent of an EV battery by weight, is treated as a byproduct, with recyclers either burning it for energy or separating it out to be landfilled.

“Up until recently, people talking about recycling for batteries really went after those token [metal] elements because they were high value … and because that recycling process can overlap quite a bit with conventional metal processing,” Ryan Melsert, the CEO of U.S. battery materials startup American Battery Technology Company, told Grist.

For graphite recycling to be worthwhile, recyclers need to obtain a high-performance, battery-grade product. To do so, they need methods that separate the graphite from everything else, remove any contaminants like metals and glues, and restore the material’s original geometric structure, something that’s often done by applying intense heat.

Crude recycling approaches like pyrometallurgy, a traditional process in which batteries are smelted in a furnace, won’t work for graphite. “More than likely you’re going to burn off the graphite” using pyrometallurgy, Keyser said.

Today, the battery recycling industry is moving away from pyrometallurgy and embracing hydrometallurgical approaches, in which dead batteries are shredded and dissolved in chemical solutions to extract and purify various metals. Chemical extraction approaches could be adapted for graphite purification, although there are still “logistical issues,” according to Keyser. Most hydrometallurgical recycling processes use strong acids to extract cathode metals, but those acids can damage the crystalline structure of graphite. A longer or more intensive heat treatment step may be needed to restore graphite’s shape after extraction, driving up energy usage and costs.

A third approach is direct recycling, in which battery materials are separated and repaired for reuse without any smelting or acid treatment. This gentler process aims to keep the structure of the materials intact. Direct recycling is a newer idea that’s further from commercialization than the other two methods, and there are some challenges scaling it up because it relies on separating materials very cleanly and efficiently. But recent research suggests that for cathode metals, it can have significant environmental and cost benefits. Direct recycling of graphite, Keyser said, has the potential to use “far less energy” than synthetic graphite production.

Today, companies are exploring a range of graphite recycling processes.

American Battery Technology Company has developed an approach that starts with physically separating graphite from other battery materials like cathode metals, followed by a chemical purification step. Additional mechanical and thermal treatments are then used to restore graphite’s original structure. The company is currently recycling graphite at a “very small scale” at its laboratory facilities in Reno, Nevada, Melsert said. But in the future, it plans to scale up to recycling several tons of graphite-rich material a day with the help of a three-year, nearly $10 million Department of Energy grant funded through the 2021 bipartisan infrastructure law.

Massachusetts-based battery recycling startup Ascend Elements has also developed a chemical process for graphite purification. Dubbed “hydro-to-anode,” Ascend Elements’ process “comes from some of the work we’ve done on hydro-to-cathode,” the company’s patented hydrometallurgical process for recycling cathode materials, said Roger Lin, the vice president of global marketing and government relations at the firm. Lin said that Ascend Elements is able to take graphite that’s been contaminated during an initial shredding step back to 99.9 percent purity, exceeding EV industry requirements, while also retaining the material properties needed for high performance anodes. In October, Ascend Elements and Koura Global announced plans to build the first “advanced graphite recycling facility” in the U.S.

The Department of Energy-backed startup Princeton NuEnergy, meanwhile, is exploring direct recycling of graphite. Last year, Princeton NuEnergy opened the first pilot-scale direct recycling plant in the U.S. in McKinney, Texas. There, batteries are shredded and a series of physical separation processes are used to sort out different materials, including cathode and anode materials. Cathode materials are then placed in low-temperature reactors to strip away contaminants, followed by additional steps to reconstitute their original structure. The same general approach can be used to treat anode materials, according to founder and CEO Chao Yan.

“From day one, we are thinking to get cathode and anode material both recycled,” Yan said. But until now, the company has focused on commercializing direct recycling for cathodes. The reason, Yan said, is simple: “No customer cared about anode materials in the past.”

That, however, is beginning to change. Yan said that over the past year—and especially in the last few months since China announced its new export controls—automakers and battery manufacturers have taken a greater interest in graphite recycling. Melsert also said that he’s starting to see “very significant interest” in recycled graphite.

Still, customers will have to wait a little longer before they can purchase recycled graphite for their batteries. The methods for purifying and repairing graphite still need refinement to reduce the cost of recycling, according to Brian Cunningham, the batteries R&D program manager at the Department of Energy’s Vehicle Technologies Office. Another limiting step is what Cunningham calls the “materials qualification step.”

“We need to get recycled graphite to a level where companies can provide material samples to battery companies to evaluate the material,” Cunningham said. The process of moving from very small-scale production to levels that allow EV makers to test a product, “could take several years to complete,” he added. “Once the recycled graphite enters the evaluation process, we should start to see an uptick in companies setting up pilot- and commercial-scale equipment.“

Supply chain concerns could accelerate graphite recycling’s journey to commercialization. Over the summer, the Department of Energy added natural graphite to its list of critical materials for energy. Graphite is also on the U.S. Geological Survey’s list of critical minerals — minerals that are necessary for advanced technologies but at risk of supply disruptions.

This classification means that domestically sourced graphite can help EVs qualify for the “clean vehicle credit,” a tax credit that includes strict requirements around critical mineral sourcing following the 2022 Inflation Reduction Act. To qualify for the full credit, EV makers must obtain a large fraction of their battery minerals from the U.S. or a free-trade partner. By 2025, their vehicles may not contain any critical minerals extracted or processed by a “foreign entity of concern” — an entity connected to a shortlist of foreign countries that includes China. This requirement could “drive a premium” for domestically recycled graphite, Lin said.

Tax incentives could be key to helping recycled graphite compete with virgin graphite, according to Yuan Gu, a graphite analyst at the consulting firm Benchmark Mineral Intelligence. Despite China’s new export controls, Gu expects graphite to remain relatively cheap in the near future due to an “oversupply” of graphite on the market right now. While Gu said that graphite recycling is “definitely on radar for Western countries” interested in securing future supplies, its viability will depend on “how costly or cheap the recycled material will be.”

If graphite recycling does catch on, industry insiders are hopeful it will be able to meet a significant fraction of the country’s future graphite needs—which are growing rapidly as the clean energy transition accelerates—while making the entire EV battery supply chain more sustainable.

“You can help regional supply chains, you can help with efficiency, with carbon footprints,” Lin said. “I think it’s a no-brainer this will happen.”