Stock Markets

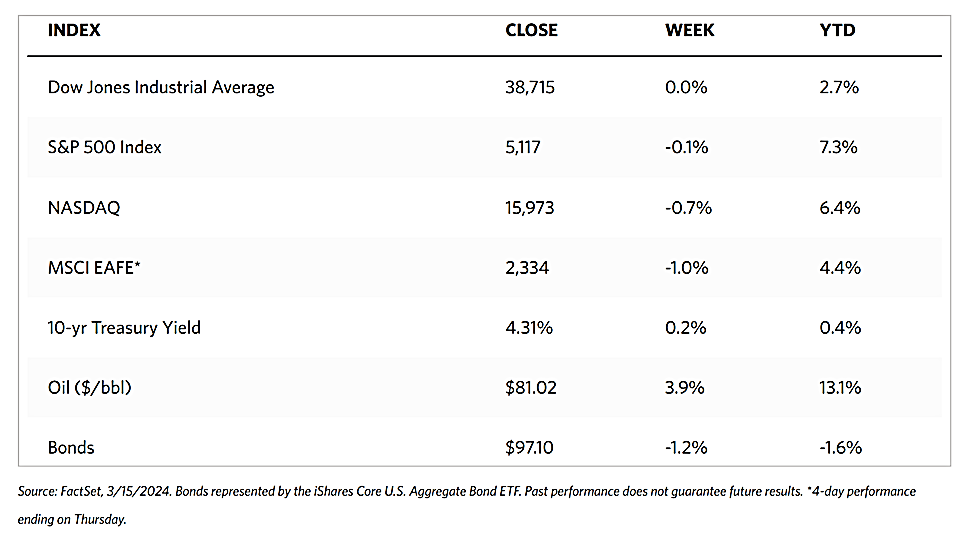

As investors weighed the upside surprises in inflation data and signs of moderating consumer spending, stocks moved mostly lower for the week. Among the major indexes, the Dow Jones Industrial Average (DJIA) held up the best, ticking downward 0.02% while the Dow Jones Total Stock Market also slipped 0.34%. The S&P 500 Index also lost 0.13% with both midcap and small-cap issues down. The technology-tracking Nasdaq Stock Market Composite likewise lost 0.70%, as did the NYSE Composite which fell by 0.23%. All Russell indexes were down.

The CBOE Volatility Index (Vix), which is an indicator of investor risk perception, descended by 2.24% over the week. The DJIA’s performance, which was the least eroded among the indexes, was helped by the record high it reached on Wednesday before falling back to end the week only slightly down. Among the sectors, energy shares outperformed due to higher oil prices, and technology shares lagged due to weakness in NVIDIA and other chipmakers.

U.S. Economy

Consumer inflation data were released on Tuesday. The consumer price index (CPI) released by the Labor Department was modestly in line with consensus expectations, rising 0.4% in February. However, core prices (excluding food and energy) rose also by 0.4% which is slightly higher than expected, It appears that investors took the upside core surprise largely in stride, in part due likely to a continued increase in shelter costs which is generally considered a lagging indicator of overall inflation trends. Apparel costs, which remained flat over the past 12 months, jumped 0.6%.

On Thursday, producer inflation data were released and, compared to the surprise caused by their consumer counterpart, triggered greater investor concern. The producer price index (PPI) rose by 0.6% in February, the most in six months. It is also roughly double consensus estimates, and even if core producer prices rose by only 0.3%, this latter indicator also exceeded expectations, albeit slightly. Headline producer prices ascended by 1.6% year-over-year, which is well above expectations and at its highest level since September. The data appears to contradict hopes that low inflation or even deflation in producer prices would eventually result in lower prices paid by consumers.

The retail sales report, which was also released on Thursday, also surprised investors with its weakness. The Commerce Department reported that retail sales climbed by only 0.6% in February, missing expectations largely due to higher gasoline prices. It should be recalled that retail sales data are not adjusted for inflation. Even online sales notably declined by 0.1% which results in a sharp deceleration from the 6.4% increase over the past 12 months. Also increasing at a slower pace are sales at restaurants and bars which rose by 0.4%. The slower growth is largely interpreted as growing caution among consumers. As if to confirm this, the survey of consumer sentiment conducted by the University of Michigan the results of which were released on Friday indicated a modest decline in consumer expectations. The survey’s lead research concluded that Americans perceived “few signals that the economy is currently improving or deteriorating.”

Metals and Mining

The gold market consolidated this week, presumably before it resumes its upward trend after digesting its strong gains over the past weeks. Analysts have opined that gold and silver are just beginning to take off to higher levels after breaking a consolidation pattern that prevailed over the years. The reason for the market’s bullishness on these precious metals is that they have been largely ignored in the broader marketplace, making the breakout with volume much more significant. While the record highs realized by gold may partially be attributed to bullish speculation, this breakout coincides with holdings in gold-backed exchange-traded funds holding at multi-year lows. This situation in the marketplace may continue to support the long-term gold uptrend.

The spot prices of precious metals were mixed. Gold lost by 1.06% from its week-ago close at $2,178.95 to end at $2,155.90 per troy ounce. Silver, on the other hand, gained by 3.62% from its closing price last week of $24.31 to end this week at $25.19 per troy ounce. Platinum gained by 2.67% from its last weekly closing price of $914.49 to close this week at $938.89 per troy ounce. Palladium likewise gained by 5.60% from its close last week at $1,023.63 to this week’s close at $1,080.98 per troy ounce. The three-month LME prices of base metals were also mixed. Copper gained by 2.86%, from its last weekly close at $8,640.50 to its recent weekly close at $8,887.50 per metric ton. Aluminum slid by 0.07% from its closing price last week of $2,253.00 to its closing price this week of $2,251.50 per metric ton. Zinc gained by 0.51% from last week’s closing price of $2,535.00 to this week’s closing price of $2,548.00 per metric ton. Tin gained by 2.36% over the week, from last week’s close at $27,607.00 to this week’s close at $28,258.00 per metric ton.

Energy and Oil

For the first time since November, the oil markets are exhibiting bullish sentiments with the breakout of Brent futures above the $85 per barrel significant price level. This may be taken as an indication that the market is finally starting to shed its bearish cautiousness. The Ukraine drone strikes on Russian refineries this week, as well as declining U.S. inventories, appear to be motivating factors for the oil price breakthrough. According to Russia’s Energy Ministry, several large-scale drone attacks took place this week on Russian refineries in Nizhny Novgorod, Ryazan, and Novoshakhtinsk, triggering an impending rise in Russia’s crude exports in defiance of OPEC+ commitments. In the meantime, China’s offshore-focused state oil firm CNOOC announced the discovery of Kaiping South in deepwater South China Sea. The find is believed to contain more than 100 million tons of oil equivalent in recoverable volumes.

Natural Gas

For the report week spanning Wednesday, March 6 to Wednesday, March 13, 2024, the Henry Hub spot price fell by $0.42 from $1.66 per million British thermal units (MMBtu) to $1.24/MMBtu, the lowest price in inflation-adjusted terms since at least 1997. Concerning Henry Hub futures prices, the price of the April 2024 NYMEX contract decreased by $0.271 from $1.929/MMBtu at the start of the report week to $1.658/MMBtu at the week’s end. The price of the 12-month strip averaging April 2024 through March 2025 futures contracts declined by $0.142 to $2.688/MMBtu.

International natural gas futures price changes were mixed throughout the report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.09 to a weekly average of $8.45/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.23 to a weekly average of $8.15/MMBtu. In the week last year corresponding to this week (week beginning March 8 and ending March 15, 2023), the prices were $14.22/MMBtu in East Asia and $14.57/MMBtu at the TTF.

World Markets

The European stock market inched upwards this week largely on robust corporate earnings and hopes that interest rates would come down soon. The pan-European STOXX Europe 600 Index went up by 0.31% in local currency terms, in effect realizing its eighth straight weekly gain. Major indexes in the region were up. France’s CAC 40 Index gained by 1.70%, Italy’s FTSE MIB put on 1.61%, and Germany’s DAX rose by 0.69%. The UK’s FTSE 100 Index advanced by 0.94%. Due to growing confidence in Italy’s economic policy and increased demand for high-yield debt ahead of a likely reduction in borrowing costs later this year, the yield spread between German and Italian benchmark 10-year sovereign bonds narrowed significantly. European policymakers debated whether an interest rate cut may be needed in June. The European Central Bank (ECB) has signaled its preference for rate cuts to happen by midyear. They see a potential for the ECB to reduce borrowing costs at every subsequent meeting this year. While the risk of service inflation may pick up, policymakers will likely focus on slowing wage growth.

Japanese equities experienced losses for the week, with the Nikkei 225 declining by 2.5% and the broad TOPIX Index descending by 2.1%. The announcement of the highest average wage rise for members of Japan’s labor unions since the early 1990s elevated the likelihood of the Bank of Japan (BoJ) ending its negative interest rate policy in the near term. The BoJ has anchored its stance on the view that monetary policy adjustments will rely on the meeting of its 2% inflation target. This, in turn, is driven by inflation accompanied by wage growth. The consensus expectations of economists are now converging around an interest rate hike to take place in March or April. The central bank’s ultra-accommodative policy has weighed heavily on the yen and, as a result, boosted many of the country’s large-cap exporters who derive their revenues from overseas. Over the week, the yen weakened to the high end of JPY 148 versus the dollar range, from about JPY 147 at the end of the previous week. The yield on the 10-year Japanese government bond rose to 0.79% from its previous level of 0.73%, reaching its highest level in approximately three months in anticipation of the BoJ adjusting its monetary policy settings.

The Chinese stock markets climbed in response to the government’s measures aimed at market stabilization, boosting investor confidence amid a weak economic outlook. The Shanghai Composite Index advanced by 0.28% while the blue-chip CSI 300 gained by 0.71% for the week. The Hong Kong benchmark Hang Seng Index rallied by 2.25%. Economic reports revealed that China’s consumer price index exceeded consensus by rising by 0.7% in February year-over-year, reversing its January decline of 0.8%. This marks the first positive reading since August 2023 as food and services prices increased and consumption surged during the weeklong Luna New Year holiday. On the other hand, the producer price index plunged by a larger-than-expected 2.7% from one year ago, accelerating from January’s 2.5% decline and marking the 17th monthly decline. This is the longest streak of declines since 2016. As China grapples with weak domestic demand, investors remained cautious on perceiving that deflation has bottomed out.

The Week Ahead

February housing starts, initial jobless claims, and the FOMC meeting are among the important economic data scheduled for release in the coming week.

Key Topics to Watch

- Home builder confidence index for February

- Housing starts for February

- Building permits for February

- FOMC interest rate decision

- Fed Chair Powell press conference

- Initial jobless claims for March 15

- Philadelphia Fed manufacturing survey for March

- S&P flash U.S. services PMI for March

- S&P flash U.S. manufacturing PMI for March

- U.S. leading economic indicators for February

- Existing home sales for February

Markets Index Wrap-Up