Stock Markets

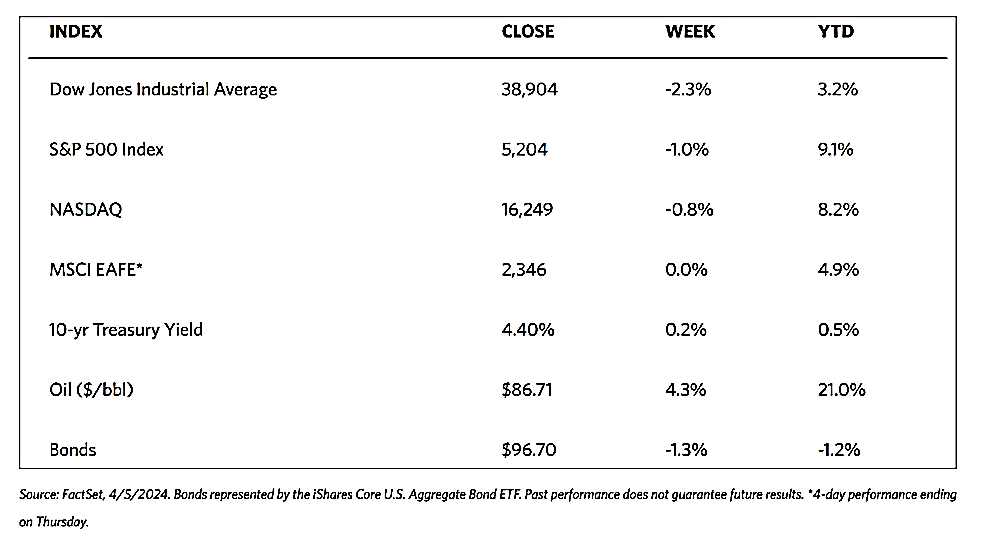

The WSJ Markets report shows that the Dow Jones Industrial Average (DJIA) fell by 2.27% while the Dow Jones Total Stock Market dropped by 1.10% for the week. The broader S&P 500 Index gave up 0.95% of its value which was mirrored in the performance of small, mid, and large-cap stocks. Technology stocks fared only slightly better as the Nasdaq Stock Market Composite lost 0.80%, while the NYSE Composite slumped by 1.04%. The CBOE Volatility Index (VIX), the indicator of investor risk perception, rose by 23.21%.

The pull-back, particularly among the large-cap indexes, occurred in tandem with U.S. Treasury yields increasing in response to signs that the manufacturing sector might finally be gaining traction. Growth stocks fared better than value shares while small-caps fell further than large-caps, suggesting that the market performance has once more narrowed. Oil prices reached their highest level since October causing energy stocks to outperform, largely on worries over rising tensions between Israel and Iran and a decision by major exporters to maintain production limits despite tight supply. The technology sector also got a boost from some late strength in Microsoft stock.

U.S. Economy

The release of the March ISM manufacturing report drove the equities market on Monday. Readings came in well above expectations and indicated expansion, though barely, for the first time in 16 months. More importantly from an inflation perspective, the ISM prices paid index surprised on the upside and seemingly confirmed recent data showing a rebound in input prices. On the other hand, the ISM services report which was released on Wednesday appeared to have a calming effect on the markets. Although it still indicated expansion, the services index slid back for the second consecutive month. More significantly, the index of prices paid fell back to its lowest level since the pandemic lockdowns began in March 2020. This data appeared to increase market participants’ hopes that a Federal Reserve rate cut may materialize in June, as reflected in futures prices.

Typically, among the most closely watched indicators of growth and inflation pressures, the Friday jobs report from the Labor Department appeared to further reassure investors. In March, employers added 303,000 jobs which is well above expectations and the most in almost a year. The solid gains came with only a modest increase in average hourly wages, from 0.2% in February to 0.3% in March, an encouraging sign from a wage pressures standpoint. Part of the reason may be traced to a rise in the labor force participation rate, indicating that employers might be enjoying an easier time filling empty slots.

Metals and Mining

This was another remarkable week that saw a nearly 5% gain for gold in a rally that seemed unstoppable. The yellow metal took off to quickly pierce what was initially thought to be a significant resistance at $2,300 so soon after it broke out of the $2,200 level. Gold’s movement this week re-established this precious metal as a global monetary asset rather than a U.S. dollar-centric asset. One of the most bullish banks on gold at the start of the year, Bank of America, reiterated its target of $2,400 per ounce. Analysts note how gold demonstrates less dependence on U.S. interest rates and monetary policy, making it less vulnerable to a future Federal Reserve decision on the likelihood of when a rate reversal takes place. In this environment, gold prices are not sensitive to whether U.S. bond yields rise or the currency strengthens. Central banks will continue to accumulate gold to diversify their foreign reserves into an asset without any third-party geopolitical risks. According to analysts, those who missed the gold rally should turn their attention to silver as the next vehicle.

The spot prices of precious metals are mostly up this week. Gold surged by 4.48%, closing this week at $2,329.75 per troy ounce, from last week’s close at $2,229.87. Silver ended this week at an impressive 10.10% higher than last week’s close at $24.96, to close this week at $27.48 per troy ounce. Platinum jumped by 2.11% from its last traded price one week ago at $911.29 to its last traded price this week of $930.56 per troy ounce. Palladium bucked the trend to end lower by 1.07%, dipping from its close last week at $1,016.55 to its close this week at $1,005.63 per troy ounce. The three-month LME prices of industrial metals closed bullish this week. Copper, which traded last at $8,867.00 one week ago, ended 5.55% up at $9,359.00 per metric ton. Aluminum shot up by 4.60% from last week’s close at $2,337.00 to this week’s close at $2,444.50 per metric ton. Zinc surged by 8.47% from its previous weekly close at $2,439.00 to close this week at $2,645.50 per metric ton. Tin gained 4.34% from its last week’s price of $27,451.00 to this week’s last trading price of $28,643.00 per metric ton.

Energy and Oil

On Friday morning, at the back of the current wave of bullish news, Brent prices broke out of the $90 per barrel threshold and quickly shot through the $91 per barrel level. Contributing factors are the anticipation of Iran’s retaliatory strike on Israel, a developing shortage in Mexico’s exports, and the continuation of OPEC+ cuts, which have recently boosted sentiment in the global oil market. It is possible, however, that the potential of the Fed not cutting interest rates this year may douse hopes on the sustainability of the oil price rally. One other consideration is the decision of the U.S. Energy Department to scrap its tender to buy 3 million barrels of strategic petroleum stocks in August and September. The decision was made to “keep the taxpayer’s interest at the forefront” in light of WTI rising to $86 per barrel in the same week.

Natural Gas

For the report week beginning Wednesday, March 27, and ending Wednesday, April 3, 2024, the Henry Hub spot price ascended by $0.42 from $1.44 per million British thermal units (MMBtu) to $1.86/MMBtu. Regarding the Henry Hub futures price, the price of the May 2024 NYMEX contract increased by $0.123, from $1.718/MMBtu at the beginning of the report week to $1.841/MMBtu at the week’s end. The price of the 12-month strip averaging May 2024 through April 2025 futures contracts climbed by $0.091 to $2.818/MMBtu.

International natural gas futures price changes were mixed this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.02 to a weekly average of $9.51/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.32 to a weekly average of $8.42/MMBtu. By comparison, the week last year that corresponds to this report week (the week from March 29 to April 5, 2023), the prices were $12.96/MMBtu in East Asia and $14.96/MMBtu at the TTF.

World Markets

European stocks descended this week as the pan-European STOXX Europe 600 lost by 1,19% in local currency terms during the holiday-shortened trading week. The drop interrupted 10 consecutive weeks of gains, attributable to investor reactions to hawkish comments from some U.S. Federal Reserve policymakers. Higher crude oil prices also heightened doubts about the timing of anticipated future interest rate cuts. Italy’s FTSE MIB plunged by 2.13%, France’s CAC 40 Index lost 1.76%, and Germany’s DAX dropped by 1.72%. The UK’s FTSE 100 Index slid by 0.52%. The headline inflation in the eurozone slowed down more than expected to 2.4% in March from 2.6% in February. Also decelerating was core inflation, which excludes volatile food and energy prices, from 3.1% to 2.9%. However, the year-over-year increase in service prices came in at 4.0% for the fifth straight month. The economic data suggests that after stagnating for the past year, the economy may be picking up. S&P Global revised its forecast, from 49.9 to 50.3 in March, for the eurozone’s composite purchasing managers’ index (PMI) which includes manufacturing and services. This is significant because a reading north of 50 indicates expansion in private-sector business activity.

Japanese stocks were under selling pressure for the week, causing the Nikkei 225 Index to slump by 3.4% and the broad TOPIX fall by 2.4%. The reasons were traced to heightened geopolitical tensions and continued uncertainty about the Federal Reserve’s monetary policy direction. Both weighed in general on global equities; on the domestic scene, Japanese investors remained concerned about whether the authorities would conduct an intervention to prop up the falling yen. According to the Finance Ministry, they remained ready to respond to excessive moves in the foreign exchange markets. The Japanese currency maintains its rate at the high-JPY 151 level against the U.S. dollar, its lowest level in the last 34 years. Over the past three years, the yen’s weakness has given Japan’s exporters an advantage, providing dollar-earning companies a major boost in so far as they derive a large share of their revenues from abroad. Speculation about intervention was propelled by signals from Bank of Japan (BoJ) Governor Kazuo Ueda that the central bank could use monetary policy to address the historic weakness in the yen. They have indicated that any action taken on the normalization of monetary policy relies on two preconditions being met – the 2% inflation target attained sustainably, and growth in wages.

Chinese equities advanced in the holiday-shortened trading week in reaction to data that suggests that the economy could be gaining traction. The Shanghai Composite Index rose by 0.92% while the blue-chip CSI 300 gained by 0.86%. The Hong Kong benchmark Hang Seng Index advanced by 1.10%. Financial markets in mainland China suspended operations on Thursday and Friday in observance of the Qingming Festival. Also known as Tomb Sweeping Day, these are the holidays when Chinese people honor their ancestors by cleaning and placing offerings on their tombs. In Hong Kong, the markets were closed on Thursday but reopened on Friday. March economic indicators strengthened hopes that China may soon see a full economic recovery. The official manufacturing PMI climbed to 50.8 in March (which was better than expected) from 49.1 in February, largely due to a rebound in production and exports, thus marking the first expansion since September 2023. The nonmanufacturing PMI grew to 53.0, a better-than-forecasted outcome for March, from 51.4 in February. On the other hand, the value of new home sales by the country’s top 100 developers dipped by 49% in March from one year ago, easing from the 60% drop in February. Although sales rose by 93% from the previous month, they remained weak compared with the monthly average for the third and fourth quarters of last year.

The Week Ahead

The CPI and PPI inflation data, as well as the FOMC minutes from the March meeting, are among the important economic data scheduled to be released in the coming week.

Key Topics to Watch

- Chicago Fed President Austan Goolsbee’s radio interview

- NFIB optimism index for March

- Consumer price index for March

- Core CPI for March

- CPI year-over-year

- Core CPI year-over-year

- Fed Gov. Michelle Bowman speaks (Wednesday, April 10)

- Wholesale inventories for March

- Chicago Fed President Austan Goolsbee speaks (Wednesday, April 10)

- Minutes of Fed’s March FOMC meeting

- Monthly U.S. federal budget for March

- Initial jobless claims for April 6, 2024

- Producer price index for March

- Core PPI for March

- PPI year-over-year

- Core PPI year-over-year

- Fed Gov. Michelle Bowman speaks (Thursday, April 11)

- Boston Fed President Susan Collins speaks

- Chicago Fed President Austan Goolsbee speaks (Thursday, April 11)

- Atlanta Fed President Raphael Bostic speaks (Thursday, April 11)

- Import price index for March

- Import price index minus fuel for March

- Consumer sentiment (prelim) for April

- Atlanta Fed President Raphael Bostic speaks (Friday, April 12)

- San Francisco Fed President Mary Daly speaks

Markets Index Wrap-Up