Stock Markets

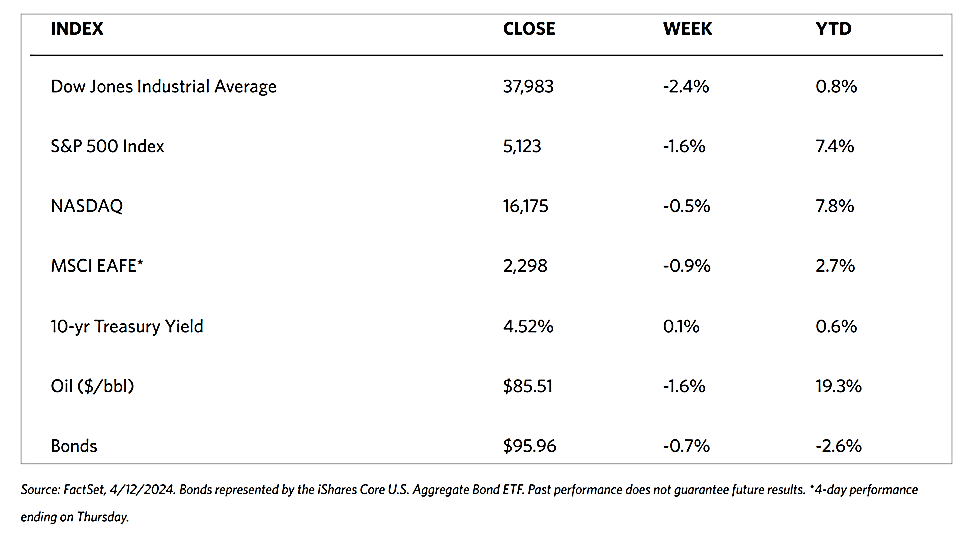

The major indexes this week all headed southward on the back of a hotter-than-expected inflation report and rising concerns of an impending Iranian retaliatory strike on Israel. The Dow Jones Industrial Average (DJIA), which tracks 30 large companies on the New York Stock Exchange and the Nasdaq, dipped by 2.37% from last week; the Dow Jones Total Stock Market did slightly better with a decline of only 1.71%. The broader S&P 500 Index fell by 1.55%, while the technology-tracking Nasdaq Stock Market Composite slid only by 0.45%. The NYSE Composite Index gave up 2.67%, while the Russell 2000 Index did worse than Russell 1000 or 3000, suggesting that small-cap stocks fell further than their large-cap counterparts.

Stocks pulled back towards the end of the week in reaction to reports that Iran was preparing to directly attack facilities on Israeli soil for the first time. Oil prices jumped on the news because of the implications of possible oil supply disruptions. The U.S. dollar also rose since it is typically viewed as a “safe haven” in times of international turmoil. The CBOE volatility index (VIX), the indicator of investor risk perception, rose by 7.99% on heightened volatility expectations. This is the VIX’s highest level since November 2023.

U.S. Economy

In the wake of the higher-than-expected inflation report, futures markets began pricing in roughly a 20% chance of a rate cut at the Federal Reserve’s meeting in June versus roughly 50% before its release. Central bank officials had a busy week for commentary at which they appeared to confirm a change in their perspective following the CPI release. The latest data did not increase the confidence of Richmond Fed Chief Thomas Barkin in disinflation, according to him, while Boston Fed President Susan Collins remarked that the recent data argue against an imminent need to cut rates. The consumer inflation data helped drive the yield on the benchmark 10-year U.S. Treasury note to its highest intraday level since November before Treasuries rallied on Friday as investors pursued U.S. dollar-based assets.

Metals and Mining

Gold continued its unprecedented rally, and with it the rest of the precious and industrial metals markets. Gold saw an intra-day price swing of $98, with volatility coming second only to the December rally that pushed gold above $2,150 an ounce. Thereafter, gold consolidated above the $2,000-per-ounce level, with some investors expecting prices to correct to $1,950. But the consolidation held above $2,000 and broke out last month. The anticipation for a pullback thus makes this week’s price action exciting, with investors who missed the initial rally now expected to buy on dips, creating a latent demand. There is a clear consensus in the marketplace that this rally is far from over.

The spot prices of precious metals were up over the week. Gold gained 0.63% from its close last week at $2,329.75 to its close this week at $2,344.37 per troy ounce. Silver closed 1.46% higher than its last price a week ago of $27.48 to its last trading price this week of $27.88 per troy ounce. Platinum climbed by 4.96% from last week’s close at $930.56 to this week’s close at $976.74 per troy ounce. Palladium, which ended last week at $1,005.63, closed this week at $1,052.45 with a gain of 4.66%. The three-month LME prices of industrial metals also chalked up gains. Copper advanced by 1.05% from last week’s closing price of $9,359.00 to end this week at $9,457.50 per metric ton. Aluminum last traded this week at $2,494.00 per metric ton, which is 2.02% higher than its last trading price one week ago at $2,444.50. Zinc shot up by 6.92% from last week’s close at $2,645.50 to this week’s close at $2,828.50 per metric ton. Tin surged by 12.95% from its closing price last week at $28,643.00 to this week’s closing price of $32,353.00.

Energy and Oil

The recent oil price rally slowed down considerably over the week due to inventory builds in the U.S., higher-than-expected inflation numbers that would likely postpone any interest rate cuts by the Federal Reserve, and attempts by Iran to play down the risk of an attack on Israel. On Friday morning, Brent was trading above the $90-per-barrel level, leaving plenty of upside risk yet in the oil markets. In the meantime, OPEC lowered its 2024 supply forecast in its latest monthly report. OPEC kept its demand forecast for this year at 2.24 million barrels per day (b/d), however, it lowered non-OPEC liquids production growth in 2024 to 990,000 b/d. This revised figure is down by 70,000 b/d from the previous month’s outlook.

Natural Gas

For the report week from Wednesday, April 3, to Wednesday, April 10, 2024, the Henry Hub spot price rose by $0.02, from $1.86 per million British thermal units (MMBtu) to $1.88/MMBtu. Regarding Henry Hub futures, the price of the May 2024 NYMEX contract increased by $0.044, from $1.841/MMBtu at the start of the report week to $1.885/MMBtu at the end of the week. The price of the 12-month strip averaging May 2024 through April 2025 futures contracts rose by $0.01 to $2.829/MMBtu.

International natural gas futures prices increased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.06 to a weekly average of $9.57/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.17 to a weekly average of $8.58/MMBtu. In the week last year that corresponds to this week (the week from April 5 to April 12, 2023), the prices were $12.61/MMBtu in East Asia and $13.84/MMBtu at the TTF.

World Markets

European stocks lost some of their value as investors factored in hawkish signals from the European Central Bank that key rates, which the markets expect to lower rates soon, will continue to be held steady for the meantime. The pan-European STOXX Europe 600 Index declined by 0.26% for the week in local currency terms. Major stock indexes followed the trend. France’s CAC 40 Index slid by 0.63%, Italy’s FTSE MIB lost 0.73%, and Germany’s DAX declined by 1.35%. On the contrary, the UK’s FTSE 100 Index defied gravity to end the week with a 1.07% gain. The supportive factor of the index is the weakness of the British pound relative to the U.S. dollar. Furthermore, the UK GDP expanded for two consecutive months suggesting that the country’s economy exited recession. The FTSE 100 includes many multinationals that generate meaningful overseas revenue denominated in dollar terms. Despite trending lower earlier in the week, the yields on German, Italian, and French government bonds jumped on news that U.S. inflation came in hotter than expected in March. Yields pulled back subsequently from these highs after the European Central Bank (ECB) held key rates steady while strongly hinting that they may soon be lowered.

Japanese equities rose over the week partly in reaction to the stronger-than-expected U.S. inflation report. The Nikkei 225 Index gained 1.4% and the broader TOPIX rose by 2.1%. Investors speculated as to whether Japan’s monetary authorities would intervene to support the yen as it hovered close to a 34-year low. Following a higher-than-expected U.S. inflation reading and subsequent increase in U.S. Treasury yields, the Japanese government bond yield rose to 0.84% from 0.77% at the end of the prior week. During the week, it briefly touched its highest level since November 2023. The finance ministry authorities stated that they were investigating the factors that prompted the currency moves and that they would act on excessive yen weakness. Bank of Japan (BoJ) Governor Kazuo Ueda, meanwhile, ruled out a rate hike in response to a weak yen. From his pronouncements, the central bank assured that it would not alter its monetary policy directly in response to exchange rate moves. Japan’s monetary policy remains one of the most accommodative in the world. Market expectations now appear to converge around two further rate hikes within the next 12 months.

Chinese stocks pulled back as weak inflation data drew attention to the lackluster demand permeating China’s economy. The Shanghai Composite Index declined by 1.62%, while the blue-chip CSI 300 fell by 2.58%. The Hang Seng Index, Hong Kong’s benchmark, experienced early gains in the week that were, however, pared by apprehensions about the flagging recovery. The country’s consumer price index rose by a below-consensus 0.1% in March year-on-year, down from 0.7% in February. The core inflation rose by 0.6% but was weaker than the 1.2% increase in February. The producer price index fell by 2.8% from last year. This is its 18th month of declines and accelerating from its February 2.7% drop. China’s exports and imports fell in March, reversing the gains realized from January and February. Exports shrank by 7.5% year-on-year in March, which was worse than expected and accelerating from a 7.1% rise in the January-to-February period. These latest results dealt a setback to China’s reliance on external demand to bolster its economy. They added further pressure on Beijing to roll out additional stimulus measures to achieve its 5% annual growth target.

The Week Ahead

Retail sales data, housing starts, and leading economic indicators are among the important economic reports scheduled for release in the coming week.

Key Topics to Watch

- Dallas Fed President Lorie Logan speaks in Tokyo

- Empire State manufacturing survey for April

- U.S. retail sales for March

- Retail sales minus autos for March

- New York Fed President John Williams TV appearance (Monday, April 15)

- Business inventories for February

- Home builder confidence index for April

- San Francisco Fed President Mary Daly speaks

- Housing starts for March

- Building permits for March

- Fed Vice Chair Philip Jefferson speaks

- Industrial production for March

- Capacity utilization for March

- Fed Chair Jerome Powell speaks

- Fed Beige Book

- Cleveland Fed President Loretta Mester speaks

- Fed Governor Michelle Bowman speaks (Wednesday, April 17)

- Initial jobless claims

- Philadelphia Fed manufacturing survey

- Fed Govern0or Michelle Bowman speaks (Thursday, April 18)

- New York Fed President John Williams speaks (Thursday, April 18)

- Existing home sales for March

- U.S. leading economic indicators for March

- Atlanta Fed President Raphael Bostic speaks (11 a,m., Thursday, April 18)

- Atlanta Fed President Raphael Bostic speaks (5.45 p,m., Thursday, April 18)

- Chicago Fed President Austan Goolsbee speaks

Markets Index Wrap-Up