Shares of Nvidia (NVDA.O), opens new tab surged nearly 7% on Tuesday, snapping out of a three-session tailspin that had erased about $430 billion from the artificial intelligence chipmaker’s market value.

Nvidia’s shares finished at $126.09, after a tumble that saw them lose around 13% from their June 18 close of $135.58. The drop followed a rally that accelerated after a 10-for-1 stock split that took effect on June 10.

“The bounce today is a normal technical bounce after a 15% drop in three days; you’re not going to go straight down every single day,” said Tom Hayes, chairman at Great Hill Capital in New York. “It’s a great company, it’s a great CEO, and you have insiders selling three-quarters of a billion worth of stock just as retail investors were getting involved with the split,” Hayes added.

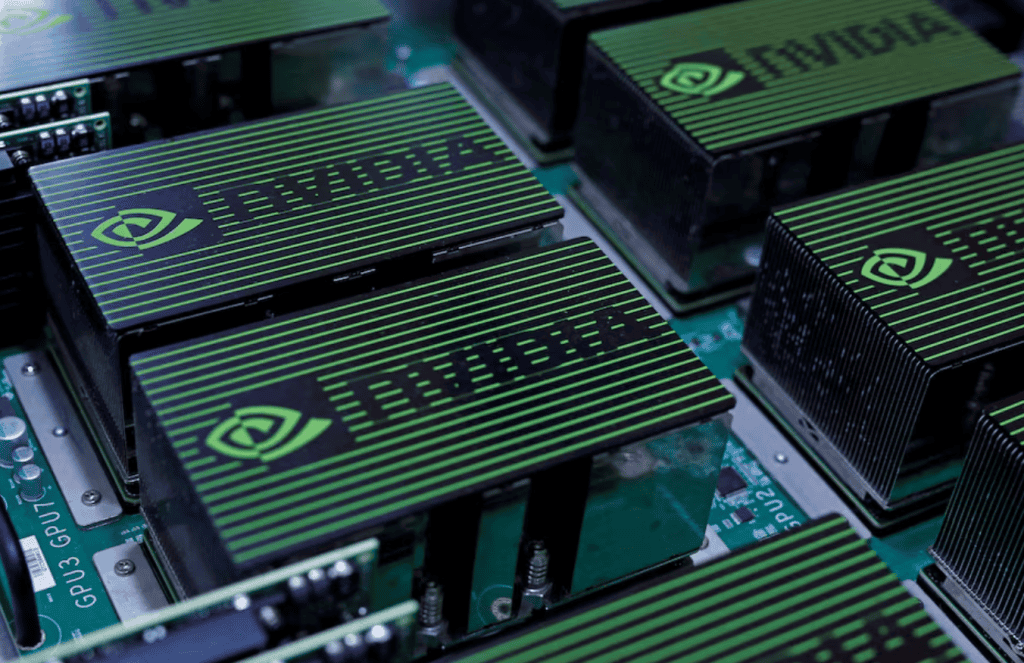

Nvidia’s breathtaking rise and its position as the dominant provider of chips to support artificial intelligence applications have made it emblematic of this year’s tech-driven boom in U.S. stocks.

Shares of Nvidia, which last week briefly became the world’s most valuable company, are up 154% this year and have accounted for nearly 30% of the S&P 500’s (.SPX), opens new tab year-to-date return as of Monday’s close, according to S&P Dow Jones Indices. The index is up 14.6% this year.

The recent selloff helped ease some worries about Nvidia’s valuation, which now stands at about $3.1 trillion from a high of about $3.3 trillion earlier this month.