Stock Markets

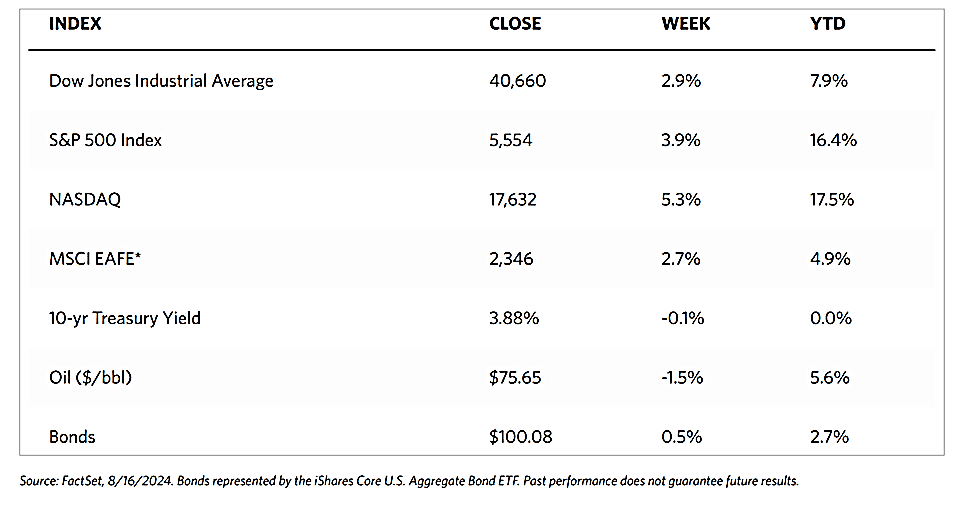

All major indexes are significantly up for the week. The Dow Jones Industrial Average gained 2.94% while the Total Stock Maret advanced by 3.86%. The broad-based S&P 500 Index surged by 3.93% and the technology-heavy Nasdaq Stock Market Composite shot up by 5.29%. The NYSE Composite Index climbed by 2.66%. The investor risk perception indicator, the CBOE Volatility Index (VIX) dropped by 27.34%.

The positive sentiment in the stock markets appears to have been driven by two themes, The first is the continued moderation of the inflation data, as both the consumer price index (CPI) and the producer price index (PPI) inflation for July came in softer than expected. The second is the resilience in the economic data which continues to hold up well for both retail sales and jobless claims which came in better than forecast. The implication may be that the US economy may be cooling, although it is certainly not on the edge of a sharp downturn or recessionary environment. Softer inflation and cooling but positive economic growth continue to support the scenario that the Federal Reserve may still cut interest rates as soon as the next FOMC meeting on September 18.

U.S. Economy

The official economic data released during the week suggested that the consumer remains resilient in the cooling labor market. The Commerce Department reported on Thursday this week that retail sales grew by 1.0% in July, the indicator’s best performance in 18 months. The volatile auto sector yielded the strongest gains, although increases were broad-based. Sales at bars and restaurants increased by 0.3% which is a sign of healthy discretionary spending. The positive sentiment seems also to align with this week’s inflation data. According to the Labor Department, after three months of solid increases, core inflation (excluding food and energy) prices paid by producers remained unchanged in July. Consumer price index (CPI) inflation, released on Wednesday, was more aligned with expectations and reassuring to investors. For the first time in over three years, the year-over-year rise in CPI fell below 3.0%.

The housing sector outlook was less encouraging. New housing activity retreated to its level in the early pandemic years. The Commerce Department reported on Friday that building permits fell below 1.4 million for the first time since the bottom of the pandemic in 2020. Actual housing starts also plunged to their lowest level in four years. A gauge of builder sentiment released on Thursday also dropped to its lowest level this year. The yield on the benchmark 10-year Treasury note declined throughout the week on the benign inflation data. It jumped on Thursday morning, however, after the announcement of the strong retail sales data. Technical factors were supportive in the tax-free municipal bond market as primary issuance was lighter than the volumes encountered in recent weeks.

Metals and Mining

The spot prices of precious metals are up for the week. Gold, which ended last week at $2,431.32, closed this week 3.15% higher at $2,508.01 per troy ounce. Silver came from $27.46 last week to end this week 5.54% higher at $28.98 per troy ounce. Platinum, last priced one week ago at $925.47, closed this week at $957.20 per troy ounce for a 3.43% gain. Palladium, which ended last week at $909.67, closed this week at $951.48 per troy ounce for an increase of 4.60%. The three-month LME prices of industrial metals have also gone up for the week. Copper ended this week at $9,115.50 per metric ton, 3.65% higher than last week’s close at $8,794.50. Aluminum closed at $2,365.50 per metric ton, higher by 4.02% over last week’s close of $2,274.00. Zinc ended last week at $2,646.00 but this week closed at $2,762.50 per metric ton for a gain of 4.40%. Tin closed this week at $31,903.00 per metric ton, 4.62% higher than last week’s close of $30,494.00.

Energy and Oil

Last week saw global markets panic on negative economic news from the U.S. What was largely a knee-jerk reaction last week propped this week up for a technical bounce-back. Oil prices climbed on a technical recovery, as both Brent and WTI prices emerged with a series of five consecutive days of price gains. Some of that upward movement was dampened by OPEC’s belated acknowledgment that 2024 demand growth will not be as outstanding as they have signaled for months. The OPEC reduced its forecast for global oil demand growth for this year resulting from weaker-than-expected first-trimester economic data and a slacker China outlook. The revised forecast is now 2.11 million barrels per day (b/d) year-over-year growth, down 140,000 b/d from the earlier forecast. Analysts also observed that investors have reduced their market positions in crude oil futures to the lowest level in at least a decade. A massive 110 million barrels were sold in the six most important contracts in the week ending August 6. The pessimistic news notwithstanding, Brent futures are still comfortably poised above $81 per barrel.

Natural Gas

For the report week from Wednesday, August 7, to Wednesday, August 14, 2024, the Henry Hub spot price climbed $0.18 from $1.99 per million British thermal units (MMBtu) to $2.17/MMBtu. Concerning Henry Hub futures, the price of the September 2024 NYMEX contract increased by $0.107, from $2.112/MMBtu at the start of the report week to $2.219/MMBtu by the week’s end. The price of the 12-month strip averaging September 2024 through August 2025 futures contracts rose by $0.081 to $3.020/MMBtu.

International natural gas futures prices increased this report week. The weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia increased by $0.12 to a weekly average of $12.62/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, increased by $0.98 to a weekly average of $12.76/MMBtu. In the week last year that corresponds to this report week (from August 9 to August 16, 2023), the prices were $11.76/MMBtu in East Asia and $11.75/MMBtu at the TTF.

World Markets

European stocks are up for the week in hopeful anticipation of another round of interest rate cuts come in early September. The pan-European STOXX Europe 600 Index ended 2.46% higher and most major continental indexes also posted strong gains. Italy’s FTSE MIB surged by 4.09%, Germany’s DAX added 3.38%, and France’s CAC 40 Index climbed by 248%. The UK’s FTSE 100 Index advanced by 1.75%. Similar to the first quarter, the Eurozone economy grew by 0.3% sequentially in the second quarter. Germany’s gross domestic product (GDP) unexpectedly contracted, but this slide was offset by GDP growth in France, Italy, and Spain. Nevertheless, industrial production contracted by 0.1% in June, failing to meet a consensus estimate for a 0.5% increase. Business activity stalled in July as well, as suggested by a purchasing managers’ survey. The labor market nevertheless remains resilient. According to Eurostat data, employment in the second quarter expanded 0.2% sequentially. In the UK, inflation slows down as the economy grows, leaving hopes for a rate cut soon. Headline inflation in the UK inched up to 2.2% in July from 2.0% in June. However, a growth in services prices, which is a focus for policymakers, slowed more than forecasted. This signals financial markets to price in a higher likelihood of interest rate cuts later this year. In the three months through June, the economy remained strong. Following a solid rebound in the first quarter after last year’s recession, GDP expanded 0.6% sequentially.

Japan’s stocks outperformed over the holiday-shortened week, rebounding off their lows in previous weeks’ trading. The Nikkei Index advanced 8.7% and the broader TOPIX Index climbed by 7.9%. The yen weakened from around JPY 146.6 per US dollar in the previous week to the high-JPY 148 range versus the US dollar. This provides Japan’s exporters a tailwind to realize stronger revenues. The better-than-expected US economic data boosted investors’ sentiment and alleviated concerns about a recession in the world’s leading economy. Japan’s second quarter, in turn, expanded by more than anticipated, thus lending further support. In the fixed-income markets, the yield on the 10-year Japanese government bond rose from 0.86% at the end of the previous week to 0.88% at the end of this week. The future monetary policy trajectory of the Bank of Japan (BoJ) continued to be the subject of speculation, after the recent comments by its deputy governor that the central bank will not raise interest rates when markets are unstable. Huge volatility resulted when the BoJ raised rates in July, leading numerous market participants to scale down their expectations for another hike this year. The country’s economy rebounded strongly in the second quarter of the year. Japan’s GDP expanded 0.8% quarter-on-quarter, ahead of estimates of 0.5% and reversing the first quarter’s 0.6% contraction. A strong uptick in private consumption and a bounce-back in business investment generally drove the rebound.

Chinese stocks advanced as investors largely ignored the weaker-than-expected economic activity. The Shanghai Composite Index rose by 0.6% while the blue-chip CSI 300 gained 0.42%. The Hong Kong benchmark Hang Seng Index was higher by 1.99%. The weakness in China’s economy was underscored by the July data. Industrial production grew by 5.1% in July year-on-year, a below-consensus performance partly due to lower auto sales. Retail sales expanded by 2.7% in July from a year earlier up from a 2% increase in June and exceeding the expected growth rate. Fixed asset investment lagged forecasts with a growth of 3.6% in the January to July period compared to last year. Property investment fell by 10.2% year-on-year. Urban unemployment grew by 5.2% from 5% the previous month. New home prices in 70 cities fell by 0.7% in July. This remains unchanged from the rate of declines in the prior two months and marked the 13th consecutive monthly decline. Buying interest remains sluggish in smaller towns even while the government’s rescue package rolled out in May has spurred demand in major cities, data suggests.

The Week Ahead

Important economic releases this week include the Leading Economic Index, the PMI composite, and the minutes of the Federal Reserve’s July FOMC meeting.

Key Topics to Watch

- Fed Governor Christopher Waller welcoming remarks (Aug. 19)

- U.S. leading economic indicators for July

- Atlanta Fed President Raphael Bostic speech (Aug. 20)

- Fed Vice Chair for Supervision Michael Barr speech (Aug. 20)

- Minutes of Fed’s July FOMC meeting

- Initial jobless claims for Aug. 17

- S&P flash U.S. services PMI for Aug.

- S&P flash U.S. manufacturing PMI for Aug.

- Existing home sales for July

- Fed Chair Jerome Powell speech at Jackson Hole retreat (Aug. 23)

- New home sales for July

Markets Index Wrap-Up