Stock Markets

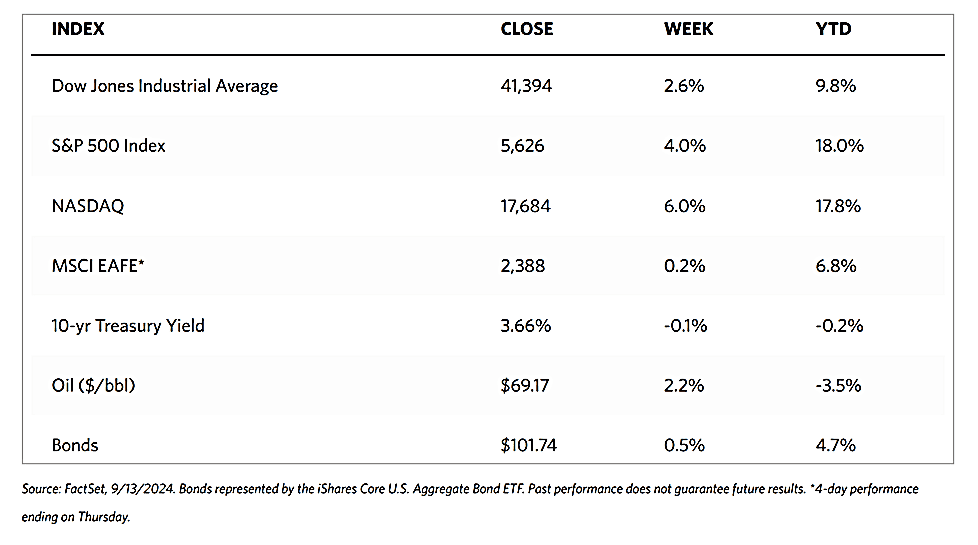

All the major U.S. stock market indexes rallied during the week. The 30-stock Dow Jones Industrial Average (DJIA) ended the week 2.60% higher, and the Total Stock Market Index climbed by 4.04%. The S&P 500 Index, a broad-based metric, ascended by 4.02%, while the technology-heavy Nasdaq Stock Market Composite jumped by 5.95%, the best-performing index for the week. The NYSE Composite Index gained 2.46%. The risk perception indicator, the CBOE Volatility Index (VIX) dropped by 26.01%.

Stocks posted solid gains this week and recovered from the steep losses of the weeks preceding it. The pullback in weeks past saw the S&P 500 Index plunge to its worst weekly decline since March 2023. For this week, growth stocks outpaced value shares by a wide margin due to the strong performance of the technology stocks that caused the Nasdaq to outperform the other indexes. After NVIDIA offered a positive outlook on artificial intelligence at an investment conference, its stock surged. The week was particularly busy generally due to numerous conferences, and this seemed to drive the week’s positive sentiment.

U.S. Economy

The Labor Department’s inflation reports dominated the week’s relatively light economic calendar. Stocks initially headed sharply lower on Wednesday on news that core consumer inflation (excluding food and energy) rose a bit higher than consensus expectations to 0.3% in August. Headline inflation, meanwhile, showed an annual increase of 2.5% which is well below the 2.9% increase in July, and its lowest level since early 2021. Other economic reports also provided some hope for the troubled housing sector. On Wednesday, the Mortgage Bankers Association reported that the average rate for a 30-year, fixed-rate mortgage dropped to 6.29%, well below the 7.21% one year ago and the lowest since February. The Association also reported that its index of home loan applications continued to climb off its August lows – a heartening sign, since this indicator is a leading signal of home purchases.

Metals and Mining

Gold is ending the week at a new all-time high above $2,500 per ounce, higher by more than 3% while silver charted an even larger percentage gain, almost 10% up. U.S. inflation surpassed analysts’ expectations, with the combined dip in U.S. Treasury yields and the U.S. dollar. These developments prompted investors to send the price of bullion skyrocketing. According to analysts, markets expect a 45% probability of a more aggressive move next week. The U.S. economy has held up relatively well, even as activity slows, so it is difficult to justify this market reaction. Consumer prices dropped more than expected this past week, but core inflation (which excludes volatile energy and food prices) increased by 3.2%, slightly up from July, which is not exactly an economy that is addressed with aggressive rate cuts. As interest rates fall worldwide, global real yields move lower, which is consistent with driving the precious metals rally seen this week.

Precious metal spot prices rebounded for the week. Gold rose by 3.21% from its closing price last week of $2,497.41 to end this week at $2,577.70 per troy ounce. Silver ended 9.95% higher than last week’s close at $27.94 to close at $30.72 per troy ounce. Platinum landed 8.00% higher than its close a week ago at $924.71 to trade last this week at $998.70 per troy ounce. Palladium ascended by 16.89% from its previous weekly close at $916.05 to close this week at $1,070.73 per troy ounce. The three-month LME prices of base metals have also appreciated. Copper, traded last week at $9,092.00, ended this week at $9,308.00 per metric ton for an increase of 2.38%. Aluminum, which closed last week at $2,378.50, settled this week at $2,471.00 per metric ton for a gain of 3.89%. Zinc rose by 6.10% from its closing price last week of $2,737.50 to end this week at $2,904.50 per metric ton. Tin closed this week at $31,805.00 per metric ton, 3.36% higher than its price last week of $30,771.00.

Energy and Oil

Oil prices edged higher this week after Hurricane Francine sparked bearish sentiments that overtook the market. As Hurricane Francine made landfall in Louisiana this week as a Category 2 hurricane, about 42% of crude oil and 53% of natural gas production was pre-emptively shut in across the US Gulf of Mexico. Some 730,000 barrels per day (b/d) and 992 million cubic ft per day were taken off the market, even if just for several days. After UN-brokered talks collapsed, a large amount of Libyan production remained shut-in, signifying that supply disruptions now total 1.5 million b/d already. With China’s pessimism peaking in the entire post-pandemic period, however, it would take more than supply disruptions for Brent to rise above its current price of $73 per barrel.

Natural Gas

For the report week from Wednesday, September 4 to Wednesday, September 11, 2024, the Henry Hub spot price rose by $0.08 from $2.06 per million British thermal units (MMBtu) to $2.14/MMBtu. Concerning Henry Hub futures, the price of the October 2024 NYMEX contract increased by $0.125 from $2.145/MMBtu at the start of the report week to $2.270/MMBtu at the week’s end. The price of the 12-month strip averaging October 2024 through September 2025 futures contracts increased by $0.025 to $2.959/MMBtu. Regional natural gas spot price changes were mixed this report week, ranging from an increase of $0.12 at FGT Citygate to a decrease of $1.07 at both the Waha Hub and Northwest Sumas.

International natural gas futures prices decreased this report week. Weekly average front-month futures prices for liquefied natural gas (LNG) cargoes in East Asia decreased $0.15 to a weekly average of $13.78/MMBtu. Natural gas futures for delivery at the Title Transfer Facility (TTF) in the Netherlands, the most liquid natural gas market in Europe, decreased by $0.52 to a weekly average of $11.76/MMBtu. In the week last year corresponding to this report week (from September 6 to September 13), the prices were $13.36/MMBtu in East Asia and $10.99/MMBtu at the TTF.

World Markets

European stocks ended the week higher on positive sentiment created by the interest rate cut from the European Central Bank (ECB). The pan-European STOXX Europe 600 rose by 1.85% in local currency terms. Major indexes likewise climbed in tandem with the pan-European index. Germany’s DAX climbed by 2.1%, France’s CAC 40 Index rose by 1.54%, and Italy’s FTSE MIB gained by 0.83%. The UK’s FTSE 100 Index added 1.12%. The ECB announced a quarter-point cut in its deposit rate to 3.5% – in line with expectations. This is a reduction in its deposit rate for the0.4% incresae second time this year. ECB’s move was prompted by signs of weakening economic growth and slowing inflation in the Eurozone. The central bank nevertheless emphasized that it remains cautious and stressed that it is not “pre-committing to a particular rate path.” The updated quarterly forecasts for headline inflation remain unchanged. However, due to stronger-than-expected services prices, core inflation was revised modestly higher for the next two years. The modified economic growth forecasts by the ECB are now one percentage point less in 2024 (0.8%), 2025 (1.3%), and 2026 (1.5%).

Japan’s stock markets ended mixed over the week. The Nikkei 225 Index gained 0.5% and the broader TOPIX Index lost by 1.0%. As the yen strengthened to the high end of the JPY 140 range against the USD from the previous week’s JPY 142.3, Japanese exporters continued to face currency headwinds amid a hawkish outlook on the monetary policy of the Bank of Japan (BoJ). The latest comments from members of the BoJ’s board bolstered expectations that the central bank will raise interest rates again this year. One member, Junko Nakagawa, said that if the outlook for Japan’s economy and inflation is realized, the degree of monetary easing will be adjusted as the current level of real rates is extremely low. Another member, Naoki Tamura, suggested that the short-term rate needs to be raised to at least around 1% in the second half of the BoJ’s projection period through fiscal year 2026 to curb upside inflation risks and maintain price stability. Although the comments were hawkish, the yield on the 10-year Japanese government bond (JGB) dipped to 0.84% from 0.86% at the end of the prior week. The JGB tracked U.S. bonds lower on speculation that the Fed could more aggressively cut interest rates by 50 basis points at the September FOMC meeting.

Chinese stocks fell due to weak inflation data that fueled concerns about a downward price-wage spiral weighing on the economy. The Shanghai Composite Index and the blue-chip CSI 300 both fell by 2.23%. The Hong Kong benchmark Hang Seng Index lost by 0.43%. China’s consumer price index (CPI) inched up by 0.6% in August year-on-year, up from 0.5% in July, but this is still below economists’ forecast. Core inflation (excluding food and energy costs) rose by 0.3% which is slower than July’s 0.4% increase and marks the lowest level in more than three years. The producer price index (PPI) fell by 1.8% from last year, deepening from July’s 0.8% drop and lagging forecasts. The PPI extends the deflation in factory gate prices that began in late 2022. The latest data encouraged calls for the government to roll out additional stimulus measures to move back a negative cycle of falling corporate revenue, wages, and spending that, if it happened, would threaten the country’s long-term growth. Other news saw exports exceeding forecast in August by rising 8.7% from one year earlier compared to 7% growth in July. China’s exports are the bright spot in China’s economy, which is mired in the prolonged property crisis.

The Week Ahead

The FOMC interest rate decision, retail sales data, and initial jobless claims are among the important economic releases expected in the coming week.

Key Topics to Watch

- Empire State manufacturing survey for Sept.

- U.S. retail sales for Aug.

- Retail sales minus autos for Aug.

- Industrial production for Aug.

- Capacity utilization for Aug.

- Business inventories for July

- Home builder confidence index for Sept.

- Housing starts

- Building permits for Aug.

- FOMC interest-rate decision

- Fed Chair Powell press conference

- Initial jobless claims for Sept. 14

- Philadelphia Fed manufacturing survey for Sept.

- Existing home sales for Aug.

- U,S. leading economic indicators for Aug.

Markets Index Wrap-Up