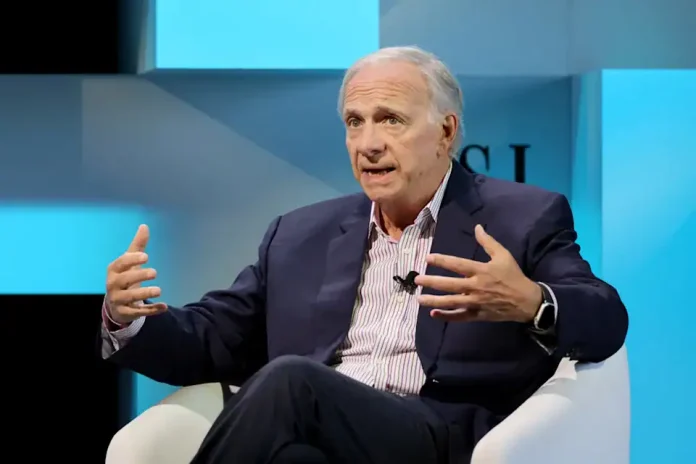

America’s bill is around $37.5 trillion — but longtime global macro investor Ray Dalio’s greater concern is who will continue to purchase the IOUs.

His concern will have major implications for Wall Street, which is on a tech rally, thanks to the gargantuan IPOs of Circle (CRCL) and CoreWeave (CRWV) , and is, perhaps, failing to heed his call.

Speaking on a Sept. 19 panel at the FutureChina Global Forum in Singapore, the Bridgewater Associates founder said the United States “cannot cut back on its spending for various reasons,” despite the emergence of a “supply-demand imbalance” in Treasurys.

That is not a thunderclap, but a trickle. Dips in markets affect prices. As Dalio said at the Forum:

The market in the world does not have that same sort of demand for that debt.

The math is already becoming louder, and sooner or later, at least according to experts like Dalio, something will have to give in the scenario.

Interest expenses have totaled around $1.13 trillion in fiscal 2025. The government is on track to spend over $7 trillion while receiving approximately $5 trillion this year, with the disparity growing over the next decade.

This is an untenable situation with major implications for the world economy, which remains dependent on the U.S. Policy suggestions are floating, but Dalio’s thesis is different: Purchasers set the coupon, and the coupon sets the tone.

If investors start demanding more to take the paper, the ripple effect extends beyond financing costs to multiples of the dollar. That’s the portfolio narrative, hidden in plain sight.

U.S. debt dynamics: Supply rises, demand shifts

The Treasury’s borrowing requirements are not declining, and the buyer mix does not resemble the quantitative easing period, which is a major concern for analysts such as Dalio.

Foreign reserve buildup has slowed; current flows are increasingly price sensitive. At home, money funds flood into bills, banks are choosier after a difficult rate cycle, and the Fed is allowing assets to roll off. Price has a greater burden — the coupon must persuade.

What’s changed since the easy-money years:

- Less price-insensitive demand: fewer automatic buyers of long duration

- Heavier auction cadence: a steady calendar that markets must digest

- Short-end preference: cash vehicles favor bills over bonds

- Quant tightening backdrop: Roll-off means the Fed isn’t a standing bid

- (The U.S.) cannot cut back on its spending for various reasons, Dalio said.

Dalio isn’t saying that a strike will happen all of a sudden. He’s talking about a sluggish term-premium buildup, which is the additional money investors desire to retain duration.

First, it shows up in auction tails and bid-to-cover softness, then in finance costs, and last in equity math.

Why current U.S. debt trends matter:

- Banks/insurers: Reinvestment yields help net interest income and portfolio returns (mind credit late-cycle).

- Cash-flow/value: Near-term cash beats distant promises as discount rates drift up.

- Long-duration growth: The farther out the earnings, the more sensitive the multiple.

- Smaller/leveraged names: Refinancing costs bite first.

- FX/commodities: Stickier U.S. yields can support the dollar; commodity paths hinge on whether growth absorbs tighter conditions.

The lesson isn’t drama, but mechanics. If the market needs a higher coupon to clear consistent supply, Wall Street leadership may shift without a single headline indicating it.

What rising yields could mean for stocks

When the clearance price for Treasurys goes up, the discount rate on future cash flows also increases. That transformation isn’t simply something you read about in a book; it impacts who is ahead and behind in the marketplace.

Financials frequently get bids as reinvestment rates go up and curves steepen, but late-cycle credit still needs to be watched. As the risk-free threshold rises, companies that make and return cash now — industrial leaders with pricing power, energy producers who operate lean, and dividend compounders — look stronger.

When yields rise, the math doesn’t just change bond prices — it rewrites equity leadership, Dalio explained.

When it comes to long-term development, the arithmetic works the opposite way. Mega-caps with robust earnings engines may make up for some of the multiple compression, but the bar becomes higher with each increase in the 10-year Treasury Note.