Taiwan’s Foxconn, the world’s largest contract electronics maker, reported record fourth-quarter revenue on Monday, driven by strong demand for artificial intelligence products.

Revenue for Nvidia’s biggest server maker and Apple’s top iPhone assembler jumped 22.07% from the same quarter last year to T$2.6028 trillion ($82.73 billion), Foxconn said in a statement.

The results exceeded the T$2.418 trillion LSEG SmartEstimate, which gives greater weight to forecasts from analysts who are more consistently accurate.

Foxconn said revenue for the quarter grew significantly on both a quarter-on-quarter and year-on-year basis, exceeding its expectations and creating a high base of comparison for the first quarter of 2026.

For the first quarter, information and communications technology products have entered a seasonal slowdown, Foxconn said in the statement. However, robust demand for AI server rack products, even against the elevated fourth-quarter base, is expected to bring performance toward the upper end of its past five-year range.

On a U.S. dollar basis, Foxconn said fourth-quarter revenue rose 26.4%.

The growth was driven by strong performance in Foxconn’s cloud and networking products division, led by booming demand for AI products, while its smart consumer electronics segment – which includes iPhones – posted a slight revenue decline due to unfavorable exchange rates.

In December alone, Foxconn posted revenue of T$862.86 billion, up 31.77% annually and a record for that month.

Foxconn, formally called Hon Hai Precision Industry, does not provide numerical forecasts. It will report fourth-quarter earnings in March.

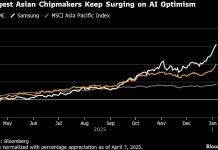

Foxconn’s shares rose 25.3% last year, in line with the broader Taiwan market. The stock closed up 1.08% on Monday ahead of the revenue data, compared with a 2.57% gain for the benchmark index.

($1 = 31.4620 Taiwan dollars)