Gold prices have been all over the place in the past one year, but some gold stocks have moved in only one direction: south. As of this writing, Canada-based gold miner Eldorado Gold (NYSE:EGO) is down a whopping 66% in one year. South African miner Sibanye-Stillwater (NYSE:SBGL) is swiftly closing in, having shed as much as half its value with the bulk of the decline coming in just the past couple of months. Among the larger gold miners, Kinross Gold (NYSE:KGC) is down about 11% in one year, or 15% year to date.

Are any of these gold stocks worth buying now? A case-by-case analysis should help you decide.

There’s some hope here

Kinross Gold wouldn’t have made it to this list if not for the stock’s drop in recent months. Kinross was, in fact, one of the top-performing gold-mining stocks in 2017, but the market hasn’t found a reason to pump more money into the stock so far this year.

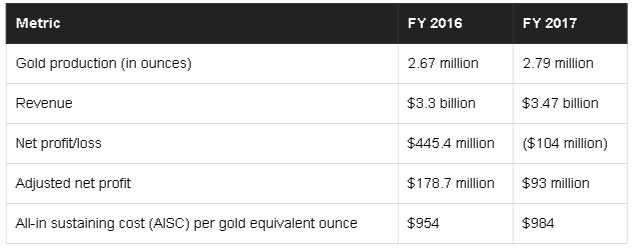

Kinross shares took a deep dive earlier in the year after the miner reported fiscal 2017 numbers. Here’s how it fared.

For fiscal 2018, Kinross expects:

- Gold production of 2.5 million ounces

- AISC of $975 per ounce

- Capital expenditure of $1.1 billion compared with $897 million in 2017

While asset impairments reversal and sale proceeds helped Kinross earn a big profit last year, lower production and higher cost estimates for 2018 didn’t go down well with the market. Higher capital expenditures could also mean lower free cash flow (FCF) — Kinross generated $54 million in FCF last year.

In May, the market pummeled Kinross again for lower first-quarter profit. In reality, Q1 was a strong quarter, with revenue climbing 13% and AISC dipping to a record low of $846 per gold-equivalent ounce. Kinross’ key phase one expansion at Tasiast is near completion and expected to boost throughput capacity to 12,000 tons per day during the latter half of the year. Other projects, including Round Mountain and Bald Mountain in Nevada and Fort Know Gilmore in Alaska, are also on schedule and budget.

We don’t see anything wrong with Kinross: It has a strong pipeline of projects that should boost production and lower costs over time, has ample liquidity at hand, strong cash flows, and no debt maturing until 2021. Gold investors might want to put Kinross’ ill-timed investments in the rearview mirror and put the stock on their radar.

Little safety in this stock

Sibanye-Stillwater is in a free fall for the worst possible reason: the death of several workers within months. Twenty of the 45 fatalities in the South African mining industry so far this year have occurred at Sibanye’s mines, as the nation’s mineral resources minister, Gwede Mantashe, recently pointed out. Not surprisingly, the stock is tumbling.

Sibanye had already drawn investors’ ire mid-last year when it announced a rights issue at a steep 60% discount to the then market price to raise funds to pare down a humongous $2.65 billion loan that it took to acquire platinum and palladium miner Stillwater Mining.

Management is planning to restructure operations, lower headcount, and enter streaming agreements in the near future to boost cash flows. Yet, it’s a sorry state of affairs at Sibanye, more so with the onus to prove its commitment toward the safety of its workers larger than ever.

The recent fatalities will also likely hit production and could compel Sibanye to downgrade its full-year production guidance from 1.24 million ounces-1.29 million ounces of gold from South African operations and 1.1 million ounces-1.15 million ounces of platinum. Those estimates are lower than the miner’s 2017 actual production, which leaves me with no reason whatsoever to recommend Sibanye today.

This gold stock has hit the danger mark

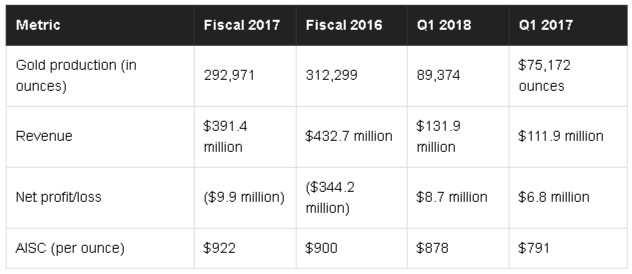

First thing first, let’s see how Eldorado Gold fared operationally in the past year or so.

Eldorado Gold’s net loss may have shrunk last year, but its loss from continuing operations (the miner sold off Chinese assets in 2016) were still higher. The miner clearly has a problem at hand: rising AISC.

The market blew up and sent Eldorado shares tumbling 40.9% in October last year after the miner downgraded its fiscal 2017 production estimates for its flagship Kisladag mine at Turkey for the second time. Investors were already worried about a more serious concern: The Greek government’s initiation of arbitration proceedings against Eldorado to settle disputes over its key developing projects, including Skouries and Olympias mines.

The recent positive news from Greece and good Q1 numbers haven’t helped as investors are clearly running out of patience, more so as there’s been no update ever since the Greek government announced intentions to “reach an agreement in the coming weeks” more than a month ago. Meanwhile, Eldorado shares have already broken the crucial $1 mark at the time of this writing. If sustained, the company could be forced to go for a reverse stock split to stay listed on the New York Stock Exchange. That’s not a great sign, and until there’s substantive progress in Greece or some encouraging news coming out of Eldorado’s second-quarter report due in a month’s time, the stock remains a risky bet.