Refinancing a personal loan can help you save interest or lower your monthly payment, but it’s not always a smart financial move. Before seeking personal loan refinancing, you should consider whether it’s a good idea, find out how you can qualify and understand the refinancing process.

When It Makes Sense to Refinance a Personal Loan

Personal loan refinancing may help you save money if you can lower your interest rate or shorten the repayment period. A lower interest rate may be an option if rates have declined, your credit or income has improved since you took out your personal loan, or you didn’t get a good rate on your first loan. Shortening your loan term could result in interest savings, since you’ll be repaying the loan over a shorter period.

However, whether you’re lowering your interest rate, shortening your term or both, make sure your interest savings exceeds any fees you may be charged to refinance, including an origination fee or prepayment penalty.

Run the numbers to see if refinancing can reduce the cost of your personal loan. Add up the remaining payments on your loan, then compare the total to the bottom line on a refinancing offer, multiplying the number of payments by the payment amount and factoring in the fees. For example, if you have 36 payments remaining with a monthly payment of $150 per month, you shouldn’t refinance unless you can get an offer with a total cost of $5,400 or less.

Sometimes, it makes sense to refinance a personal loan if you want to switch the interest rate type. Personal loan interest rates can either be fixed or variable, which means they may change if benchmark interest rates change.

If interest rates are rising, it may make sense to refinance from a variable-rate loan to a fixed-rate loan to keep your monthly payment from increasing. If interest rates are falling, it may make sense to refinance from a fixed-rate loan to a variable-rate loan, which would offer savings if rates decrease.

When It Doesn’t Make Sense to Refinance a Personal Loan

Refinancing a personal loan isn’t always a good idea. Technically, you can refinance a personal loan as many times as you can get approved. That said, if you take out a personal loan to consolidate debt but run up your credit cards up again, refinancing probably won’t help you solve your debt problem, says Janene Tompkins, certified financial planner in North Carolina and owner of Common Sense Financial Planning.

While lengthening the repayment period to lower your payments may offer relief if you’re struggling with monthly payments, it doesn’t eliminate the debt, and you’ll likely pay more interest and fees over the life of the loan. This could make getting out of debt more difficult.

“A longer term may reduce your monthly payments, but it also means that you have to pay the loan for a longer period,” says Sahil Vakil, founder of registered investment adviser firm MYRA Wealth.

Refinancing can incur origination fees and prepayment penalties, which can add to the amount of debt you owe. Refinancing personal loans and adding fees and interest along the way can extend the cycle of debt. Your goal should be to pay off the debt, not carry it for a longer period of time.

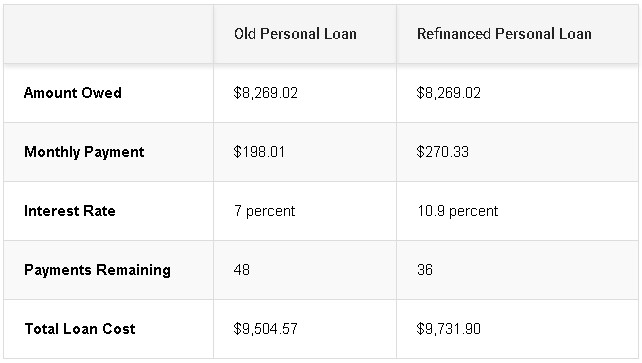

If you want to save money by shortening your loan term, it may not make sense to refinance your personal loan unless you can secure a lower interest rate. In fact, refinancing to a shorter term with a higher interest rate may actually be more expensive. Here’s an example:

Personal Loan Refinancing Requirements

Some lenders don’t have different requirements for refinancing personal loans compared with taking out an original personal loan. Lenders are typically concerned with your ability to repay the loan, not whether it’s a new loan or used to refinance an existing loan, says Keith Dragisich, commercial lending vice president at Farmers State Bank of Hamel in Minnesota. However, some lenders may require you to meet certain guidelines to refinance a personal loan.

For instance, the lender Payoff requires you to pay your original personal loan down to 95 percent or less of the original balance before refinancing. Check with the lenders you’re considering to see if they have any special requirements for refinancing a personal loan.

Most lenders require a minimum credit score to approve your personal loan application. Depending on the lender, you’ll likely need a credit score of at least 600 to qualify for personal loan refinancing. The interest rate you qualify for generally improves if you have a higher credit score.

Lenders examine your finances to see if you can afford to repay the loan. Typically, they consider your debt-to-income ratio, which is your monthly debt payments divided by your monthly income. Lenders usually calculate the debt-to-income ratio after adding in the new personal loan payment and removing any debt payments that will no longer exist after the loan is refinanced, says Dragisich. Like with credit score requirements, the maximum debt-to-income ratio accepted varies by lender but is generally 50 percent or lower.

Before You Apply for Personal Loan Refinancing

Many lenders allow you to prequalify for a loan and get your rate with a soft credit check, which won’t negatively affect your credit score. Prequalification is different from a full application, which requires a hard pull of your credit and can affect your credit score.

If a lender you’re considering doesn’t offer prequalification, check your credit score before you apply and compare it with the lender’s minimum credit score requirement.

When comparing prequalified offers, request a detailed loan offer that lists the fees you should expect to pay for your new personal loan. While fees will vary from lender to lender, look for application fees, documentation fees, origination fees, late fees, returned payment fees, payment processing fees, prepayment fees, annual fees, maintenance fees, administrative fees, paper copy fees and credit insurance fees.

Compare the total cost of the loan including interest and fees to determine which loan is best for you. Just because a loan has no fees doesn’t mean it offers the lowest overall cost. A loan with a handful of reasonable fees and a lower interest rate may be a better option for you.

Applying for a Personal Loan Refinance

After you’ve compared preapproval offers, you should submit a full application to the lender with the best offer for your needs. “Be honest [and] upfront about what debts you have and your credit challenges,” says Dragisich. It could speed up the application process.

Lenders may ask for some or all of the following information:

- Your personal information (name, address, length of time at address, previous addresses, Social Security number, driver’s license number, date of birth)

- Planned use for the funds

- Amount requested

- Requested loan term

- Employment

- Income (pay stubs, W-2s, tax returns, or other verification for income such as alimony or child support)

- Other debts

- Rent or mortgage

- Bankruptcies, judgments or garnishments

- Owned assets

- Collateral offered for secured loans

- Bank accounts (checking accounts, savings accounts, safe deposit boxes, loans, certificates of deposit)

- Joint applicant or co-signer

Alternatives to Personal Loan Refinancing

If you can’t refinance your personal loan or realize refinancing isn’t the best option for you, you may have other options to address your financial needs.

Making extra principal payments on your current personal loan can reduce the total amount of interest you’ll pay and allows you to pay the loan off faster. While your monthly payment may remain the same after making extra principal payments, your loan will be paid in full faster than if you continue to only make the standard payment each month.

A home equity loan or line of credit might be a better option because the terms are typically more favorable than personal loan terms, says Tompkins. These products may allow you to obtain a lower rate on your debt and extend the repayment period. Since home equity loans and lines of credit are secured debt, you may be able to obtain approval even if you’re denied for a personal loan.

Credit cards with a zero percent introductory annual percentage rate period for balance transfers may have a lower cost. Introductory periods only last for a limited time – generally 12 to 18 months – before the rate increases to the standard APR, but if you can pay off your debt within that time, you could avoid paying any interest. Make sure you read the fine print, though, looking for costs including balance transfer fees that make these offers cost more than the zero percent rate they advertise, says Tompkins