Stocks finished the week on high note even as the U.S. government appeared headed for a shut down. But are the risks for the market growing?

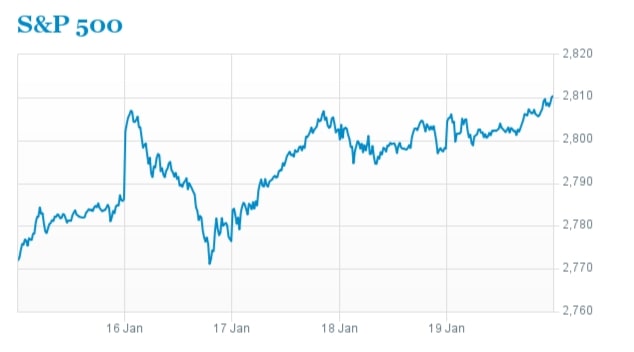

It’s hard to feel that way after a week like this. The S&P 500 rose 0.9% this week after gaining 0.4% to 2810.30 today, while the Dow Jones Industrial Average climbed 268.53 points, or 1.04%, this week after advancing 53.91 points, or 0.2%, to 26,071.72. The Nasdaq Composite jumped 1% this week after gaining 0.6% to 7336.38 today. The S&P 500 and Nasdaq finished the week at all-time highs.

The market has been dispensing new highs like a broken vending machine dispenses candy–the S&P 500 has hit 10 of them so far this year–and sometimes it’s hard to imagine what could go wrong. But imagine we will–or we’ll let James Stack of InvesTech Research do it for us. In a note today, he contrasts this leg of the bull market–the one that began 18 months ago– with what came before. During the first years of the bull, everyone worried about double-dip recessions, the Eurozone debt crisis, deflation, you name it. And there were selloffs galore–14 drops of 5% or more and three double-digit drops that raised the specter of a bear market.

Through it all, his firm recommended allocating 83% of a portfolio, on average, to stocks. Now, he says, the lack of volatility has caused investors to become complacent, pushing valuations to nosebleed levels. For the time being, everything looks OK, but Stack contends the risks are rising. “This runaway train will not last forever and, based on historical precedent, the likelihood of a correction in the coming weeks or months is extremely high,” Stack says.

He’s not the only one that’s worried. Sundial Capital Research’s Jason Goepfert notes that there is now almost $4 in every leveraged long exchange traded funds there is just $1 in leveraged short ETFs, and the ratio has quadrupled in the past year. While some of the rise has to do with the market’s rally, but exposure to long leveraged ETFs is growing faster than exposure to the S&P 500 itself, says Goepfert, who calls it a “kind of irrational exuberance. While the ratio itself doesn’t necessarily mean that stocks are headed for a fall, “we’d still consider it a warning sign,” he says.

These days, it seems like everything is.