Houston, we have liftoff.

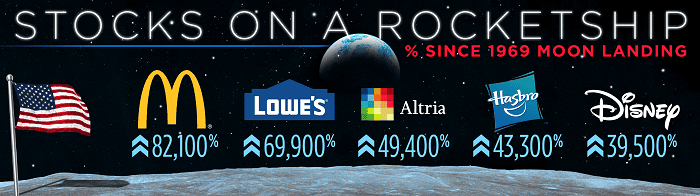

Fifty years ago, man landed on the moon and a handful of stocks took off into the stratosphere. Since July 1969, McDonald’s has rocketed more than 82,000%, Lowe’s nearly 70,000%, Altria 49,000%, Hasbro 43,000% and Disney 40,000%.

At least one of those stocks still has more fuel in its jet, says Craig Johnson, chief market technician at Piper Jaffray.

“If you look at McDonald’s, it’s been a slow and steady burn higher here in this stock and from our perspective, there’s been this really nice price channel that’s been unfolding over the past five years,” Johnson said Thursday on CNBC’s “Trading Nation. ”

“A move to the upper end of the price channel can put this stock up toward $265, so from our perspective that’s one that we would continue to focus on,” said Johnson.

A rally to $265 implies 23% upside from current levels. It would also mark a record for the stock, which hit an all-time high Thursday.

“The second stock is Disney,” Johnson added. “This stock has been forming a really nice consolidation over the last five years. It recently just broke out. We added it into our model portfolio and from our perspective based upon the size of the breakout, we could see this stock moving up toward $160. So clearly this is a stock that has more room to run.”

Disney could add another 13% before it hits $160, also a record high for the stock, which hit an all-time peak a week ago.

Quint Tatro, president of Joule Financial, says Disney is the best in show among the top winners over the last half century.

“This is a company that continues to reinvent themselves. We like them. We own them. We do believe in the next 50 years, we’ll still be talking about Disney,” said Tatro.

However, Tatro is more excited about the companies whose innovation will dominate the consumer space, and stock market, over the next 50 years.

“We do like what we believe are the future of great American franchise companies like an Uber or a Lyft and, I know not very popular, but our belief is that these industry-revolutionizing companies are going to be the ones that compound over the next several decades and the ones that provide the great opportunities going forward, ” said Tatro.

Ride-hailing companies Uber and Lyft have underperformed since making their market debut earlier this year. Uber is trading 3% below its March IPO price, while Lyft has climbed 9% off its own.