Uber just reported second quarter results including revenue that beat analysts’ expectations but declined by about 29% from $3.17 billion during the same period last year. The stock dipped more than 2% in after-hours trading.

Here’s how the ride-hailing and food delivery company did versus what Wall Street expected:

- Losses: $1.02 per share vs. 86 cents per share (adj.) expected, according to a consensus of analysts surveyed by Refinitiv.

- Revenue: $2.24 billon vs. $2.18 billion, as per Refinitiv.

Here’s how the business units performed versus what analysts expected for the quarter:

- Rides (gross bookings): $3.05 billion vs. $3.47 billion expected, according to estimates compiled by StreetAccount

- Eats (gross bookings): $6.96 billion vs. $6.57 billion expected, as per StreetAccount.

During the period ending June 30, 2020, the coronavirus pandemic continued to limit people’s travel and commuting, and to weigh heavily on Uber’s core ride-hailing business, sending gross bookings down 73% in constant currency measurements. The pandemic did drive demand for Uber’s food delivery business, however, and bookings were up 113% there.

On an earnings call Thursday, CEO Dara Khosrowshahi said, “The Covid crisis has moved delivery from a luxury to a utility.” He believes Uber users will continue to order food and other items through Uber delivery services even after the pandemic subsides, and stay-at-home orders are lifted.

Among other new delivery services the company is offering, Uber Connect lets users send small packages via UberX drivers to local destinations. The service has made 3 million trips globally since it launched in early June, the CEO said.

He also said that the ride-hailing business was recovering at different rates in different parts of the world. Khosrowshahi said, “When cities move again so does Uber.” Rides were down 50% to 85% in top U.S. markets during the second quarter, he said, but in top European markets, including France, Spain and Germany, rides were only down about 35% year-over-year.

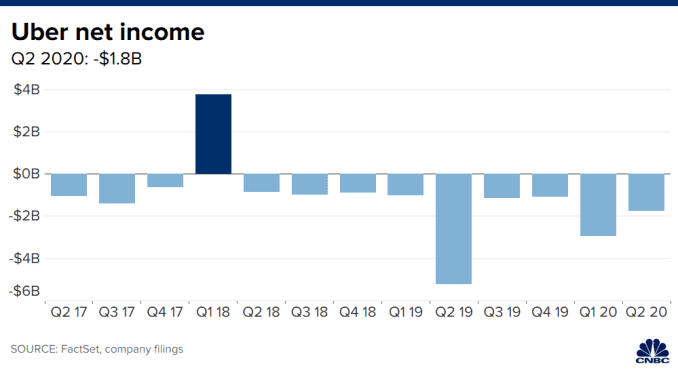

The company was able to narrow its net losses to $1.8 billion, a major improvement from last year when stock-based compensation contributed to a net loss of $5.24 billion.

The company reported $8.1 billion in cash and equivalents, down from $13.7 billion a year ago.

After Covid-19 began to have a major impact on Uber’s business, the company moved fast to lay off about 14% of its workforce, more than 3,500 employees, and to offload its Jump electric bike business to a bike-sharing competitor called Lime, in which Uber is an investor.

Despite the efforts to cut some costs, Uber has remained acquisitive. In July, it announced plans to buy Postmates, an on-demand delivery venture, for $2.65 billion in stock.

On Wednesday, Uber announced it would acquire Autocab, a U.K. taxi software business, for an undisclosed amount. Among other things, Autocab connects riders to local taxi operators via its iGo Marketplace app. The deal should help Uber expand from 40 U.K locations to 170.

Uber’s business also faces mounting legal battles over whether Uber and competitors like Lyft can continue to treat drivers in the United States as independent contractors. Hiring employees, rather than treating workers as independent contractors, generally costs companies more and makes them more liable for the conduct of these workers while they’re on the job.

On Wednesday, the California Labor Commissioner’s office announced that it had filed separate lawsuits against Uber and Lyft accusing them of committing wage theft by misclassifying drivers as contractors rather than employees.

In addition, California recently enacted a law (AB-5) that makes it hard for “gig economy” companies, including Uber, to classify workers as independent contractors, a New York federal judge ruled that Uber and Lyft drivers must be paid unemployment benefits, and the Pennsylvania Supreme Court ruled that an Uber driver was not self-employed and should have been eligible for unemployment compensation.