The value of Bitcoin is skyrocketing. If you’re planning on selling now and pocketing the gains, Uncle Sam is going to want his share.

This week, the cryptocurrency hit price it hasn’t seen since 2017, climbing toward $18,000 for one unit of Bitcoin. Over the course of 2020, it’s price has risen by more than 150%.

Just be aware that whether you mined, purchased or sold your share of Bitcoin this year – or any other cryptocurrency – you’ll have to tell the IRS when you file your taxes next spring.

Indeed, the front page of the individual income tax return, aka Form 1040, asks a yes or no question: “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?”

“That’s one of the things taxpayers need to pay attention to,” said Kirk Phillips, CPA and member of the American Institute of CPAs’ Virtual Currency Task Force.

“We’ve seen CPA firms that haven’t really wrapped their head around this stuff,” he said.” They have filed the returns but didn’t correctly check the box or didn’t report the transactions.”

Not just buying and selling

The IRS doesn’t just want to know about whether you’ve bought or sold any virtual currency during the year.

You’re still expected to check the “Yes” box on the front of your tax return if you received any crypto for free, according to newly released draft instructions from the IRS.

The same applies if you received your Bitcoin in exchange for goods or services or if you swapped it for other property, including other virtual currency.

This also means you’ll need to keep careful records of your transactions over the course of the year, which can get tricky if you’re swapping different cryptocurrency or using different exchanges or platforms, like Coinbase or Cash App.

“People have multiple exchanges and the more spread out the cryptocurrency is, the more challenging it is to gather it together and do your calculations,” said Phillips of the AICPA.

Understanding your tax treatment

In general, the IRS considers virtual currency to be property – the same way it treats stocks or other investments.

This way, if you bought some Ethereum and then sell it or if you swap it for something else, you’ve incurred a capital gain or a capital loss. If you captured a gain, then you’re responsible for taxes.

Here’s where things can get confusing: Major cryptocurrency exchanges may provide taxpayers with a Form 1099-K with these details – if they’ve had gross payments exceeding $20,000 and they’ve made more than 200 transactions.

“That threshold is so high,” said Andy Phillips, director at The Tax Institute at H&R Block.

“A lot of taxpayers either don’t do a lot of transactions,” he said. “Or if they do many of them, they use multiple exchanges and don’t hit the threshold on any one exchange.”

Even if you miss the threshold, you’re still required to report the transaction and pay taxes owed.

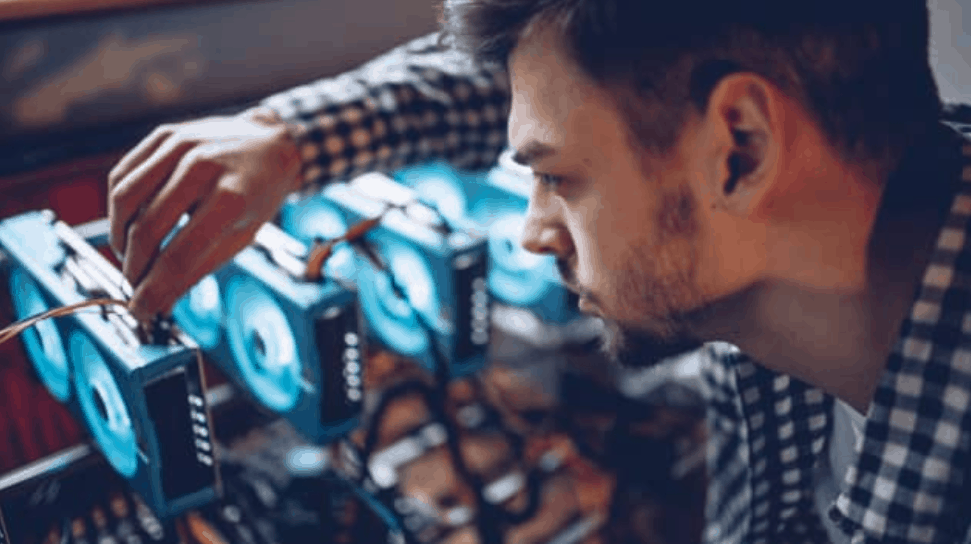

Getting paid and mining

If you received virtual currency from an employer, then it’s treated like wages. Federal income taxes and FICA taxes apply. It will be reported on your Form W-2, which you should receive from your employer by the end of January.

If you mine cryptocurrency, you’re also required to include it in your taxable income. You would include the fair market value as of the date you received it.

The IRS has been cracking down on unreported transactions in recent years. Last year, the agency sent letters to more than 10,000 taxpayers with virtual currency transactions, telling them to pay back taxes and file amended returns.

Failing to report income can carry hefty penalties and interest. In the worst case, you could go to prison and be fined up to $250,000.

Three crucial factors

Don’t just track your transactions.

There are three crucial factors that taxpayers should be aware of when they’re using cryptocurrency, said Mark Luscombe, CPA, principal federal tax analyst at Wolters Kluwer Tax & Accounting.

They are the fair market value of the virtual currency at the time of the transaction, your basis – the amount you originally paid when you acquired the asset – and the holding period.

“If the holding period is greater than one year, it’s considered long-term capital gains,” said Luscombe. “If it’s less than one year, it’s ordinary income.”

The difference in tax treatment is stark: Long term capital gains are subject to rates of 0%, 15% or 20%, while ordinary income rates can be as high as 37%.

Several software providers have emerged – including LukkaTax and Bitcoin.Tax — to help individuals keep track of their transactions and basis.

Expect the taxman to take a hard line with compliance around crypto.

“In the IRS’s view, the taxpayer should’ve had guidance about how these things are treated by them for some time, and ignorance of the law is no excuse,” said Luscombe.