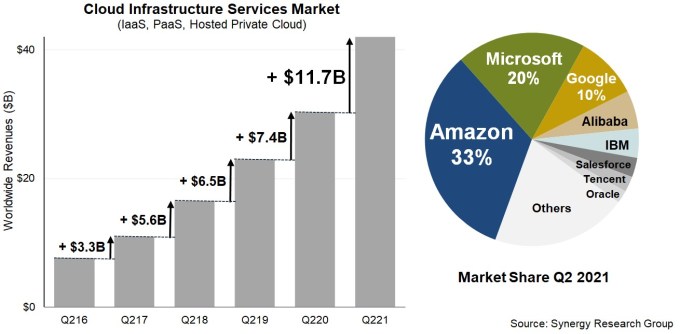

It’s often said in baseball that a prospect has a high ceiling, reflecting the tremendous potential of a young player with plenty of room to get better. The same could be said for the cloud infrastructure market, which just keeps growing, with little sign of slowing down any time soon. The market hit $42 billion in total revenue with all major vendors reporting, up $2 billion from Q1.

Synergy Research reports that the revenue grew at a speedy 39% clip, the fourth consecutive quarter that it has increased. AWS led the way per usual, but Microsoft continued growing at a rapid pace and Google also kept the momentum going.

AWS continues to defy market logic, actually increasing growth by 5% over the previous quarter at 37%, an amazing feat for a company with the market maturity of AWS. That accounted for $14.81 billion in revenue for Amazon’s cloud division, putting it close to a $60 billion run rate, good for a market leading 33% share. While that share has remained fairly steady for a number of years, the revenue continues to grow as the market pie grows ever larger.

Microsoft grew even faster at 51%, and while Microsoft cloud infrastructure data isn’t always easy to nail down, with 20% of market share according to Synergy Research, that puts it at $8.4 billion as it continues to push upward with revenue up from $7.8 billion last quarter.

Google too continued its slow and steady progress under the leadership of Thomas Kurian, leading the growth numbers with a 54% increase in cloud revenue in Q2 on revenue of $4.2 billion, good for 10% market share, the first time Google Cloud has reached double figures in Synergy’s quarterly tracking data. That’s up from $3.5 billion last quarter.

After the Big 3, Alibaba held steady over Q1 at 6% (but will only report this week), with IBM falling a point from Q1 to 4% as Big Blue continues to struggle in pure infrastructure as it makes the transition to more of a hybrid cloud management player.

John Dinsdale, chief analyst at Synergy, says that the Big 3 are spending big to help fuel this growth. “Amazon, Microsoft and Google in aggregate are typically investing over $25 billion in capex per quarter, much of which is going towards building and equipping their fleet of over 340 hyperscale data centers,” he said in a statement.

Meanwhile, Canalys had similar numbers, but saw the overall market slightly higher at $47 billion. Their market share broke down to Amazon with 31%, Microsoft with 22% and Google with 8% of that total number.

Canalys analyst Blake Murray says that part of the reason companies are shifting workloads to the cloud is to help achieve environmental sustainability goals as the cloud vendors are working toward using more renewable energy to run their massive data centers.

“The best practices and technology utilized by these companies will filter to the rest of the industry, while customers will increasingly use cloud services to relieve some of their environmental responsibilities and meet sustainability goals,” Murray said in a statement.

Regardless of whether companies are moving to the cloud to get out of the data center business or because they hope to piggyback on the sustainability efforts of the Big 3, companies are continuing a steady march to the cloud. With some estimates of worldwide cloud usage at around 25%, the potential for continued growth remains strong, especially with many markets still untapped outside the U.S.

That bodes well for the Big 3 and for other smaller operators who can find a way to tap into slices of market share that add up to big revenue. “There remains a wealth of opportunity for smaller, more focused cloud providers, but it can be hard to look away from the eye-popping numbers coming out of the Big 3,” Dinsdale said.

In fact, it’s hard to see the ceiling for these companies any time in the foreseeable future.