A radical plan to transform Switzerland’s financial landscape by barring commercial banks from electronically creating money when they lend was resoundingly rejected by Swiss voters on Sunday.

More than three quarters rejected the so-called Sovereign Money initiative, according to the official result released from the Swiss government.

All of the country’s self-governing cantons also voted against in the poll, which needed a majority from Switzerland’s 26 cantons as well as a simple majority of voters to succeed.

Concerns about the potential risks to the Swiss economy by introducing a “vollgeld” or “real money” system appear to have convinced voters to reject the proposals.

The Swiss government, which had opposed the plan because of the uncertainties it would unleash, said it was pleased with the result.

“Implementing such a scheme, which would have raised so many questions, would have been hardly possible without years of trouble,” Finance Minister Ueli Maurer said.

“Swiss people in general don’t like taking risks, and …the people have seen no benefit from these proposals. You can also see that our banking system functions…The suspicions against the banks have been largely eliminated.”

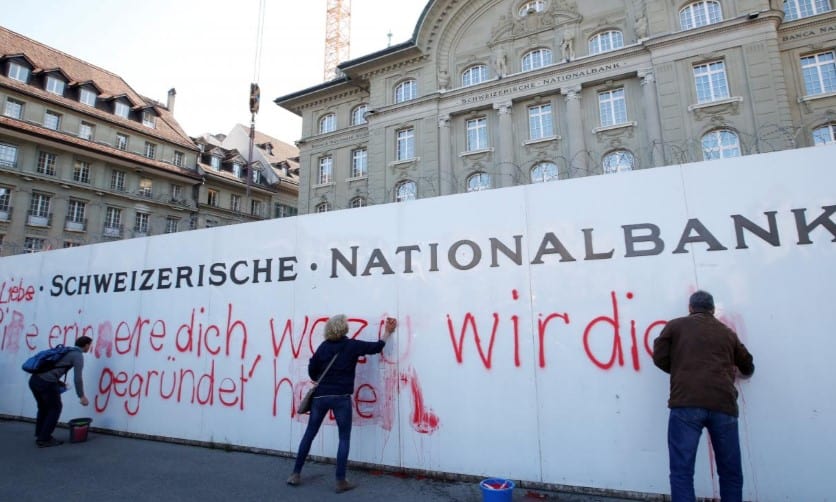

The vote, called under Switzerland’s system of direct democracy after gathering more than 100,000 signatures, wanted to make the Swiss National Bank (SNB) the only body authorized to create money in the country.

Contrary to common belief, most money in the world is not produced by central banks but is instead created electronically by commercial lenders when they lend beyond the deposits they hold for savers.

INFLATION WORRIES

This arrangement, underpinned by the belief that most debts will be repaid, has been a cornerstone of the global capitalist system but opponents say it is unstable because the new money created could exceed the rate of economic growth, which could lead to inflationary asset bubbles.

If approved, Switzerland, famed for its banking industry, would have been the first country in the world to introduce such a scheme, leading opponents to brand the plan a dangerous experiment which would damage the economy.

The plan could have had repercussions beyond Switzerland’s borders by removing a practice which underpins most of the world’s bank lending.

Support for reform had grown in the wake of the 2008 economic crisis, with campaigners saying their ideas would make the financial system more secure and protect people’s savings from bank runs.

As well as the Swiss government, opposition came from the Swiss National Bank and business groups.

“We are pleased, this would have been an extremely damaging initiative,” said Heinz Karrer, president of business lobby Economiesuisse.

The SNB acknowledged the result, saying adoption of the initiative would have made it much harder to control inflation in Switzerland.

“With conditions now remaining unchanged, the SNB will be able to maintain its monetary policy focus on ensuring price stability, which makes an important contribution to our country’s prosperity,” it said in a statement.

Campaigners – a group of academics, former bankers and scientists – said they would continue to work on raising their concerns.

“The discussion is only just getting started,” said campaign spokesman Raffael Wuethrich. “Our goal is that money should be in the service of the people and not the other way around and we will continue to work on it.”