Investors dumped technology stocks on Monday after it surfaced that a research firm, Cambridge Analytica, had accessed Facebook user data.

Many of these stocks, including Microsoft (ticker: MSFT) and Apple (AAPL), hadn’t fully recovered from their losses by midweek amid all of the carnage.

Still, even in a week of so much turmoil for tech stocks, investors shouldn’t dismiss their income potential.

For one thing, the yields on larger-cap tech names have been creeping up. There was a time when these companies used their free cash to fund further growth, something that typically happens earlier in a company’s history. But some of these companies have reached middle age, meaning they are growing more slowly and have more cash to return to shareholders.

Tech stocks in the Standard & Poor’s 500 index yielded a mere 0.2% at the end of 2000. By the end of 2017, that stood at 1.3%, although it had been even higher—1.8%—at the end of 2012, according to Sam Stovall, chief investment strategist at CFRA.

Tech and consumer discretionary have traditionally been two of the lowest-yielding sectors. By contrast, utilities in the S&P 500 were yielding 3.4% at the end of last year, and telecoms were at 5.1%.

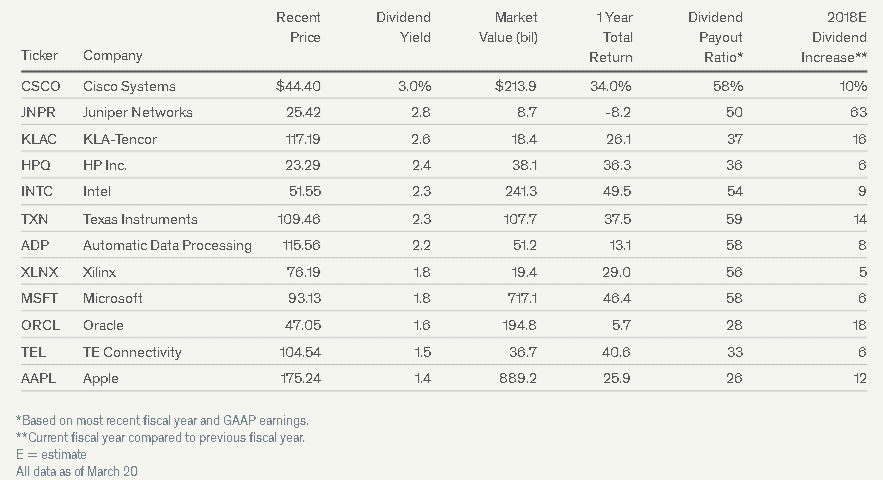

Yet Stovall points out that there are 19 tech firms in the S&P 500 with dividend yields equal to or greater than the overall market. Some of those companies appear in the accompanying table. The S&P 500 yields about 1.9%.

Devin Armstrong, co-manager of the Invesco Comstock fund (ACSTX), says that legacy technology companies have changed their approach to returning their capital to shareholders in a big way. At one point, they relied heavily on share buybacks, though not consistently.

But over the past decade, he says, “companies are returning more capital to shareholders,” and the mix has been shifting more toward dividends.

Tech Yields

Tech stocks aren’t often considered the best dividend plays, but many of these established firms sport decent yields.