The US Dollar depreciated during the second half of Friday’s trading session on softer-than-expected local GDP data as anticipated. In the second quarter, the economy grew at 4.1% versus 4.2% expected which was the fastest pace since 2014. A rosy part of the data was that personal consumption, the largest portion of economic growth in the US, grew 4.0% versus 3.0% anticipated.

Overall expectations for this data were high and US two-year government bond yields edged only cautiously lower. Nevertheless, other relatively high yielding FX majors were quick to capitalize on USD weakness. The sentiment-linked Australian and New Zealand Dollars edged higher even though there was a poor performance on Wall Street.

There, the S&P 500 declined 0.66% and the NASDAQ Composite fell to a two-week low. What really weighed down on those equities were information technology. Twitter and Intel Incplunged 20% and 8.6% respectively as the former missed monthly users while the latter faced a delay in onboarding a new chip. If 20% sounds familiar, Facebook Inc. also coincidentally plummeted that amount on its earnings data.

While the anti-risk Japanese Yen rose during the plunge in US equities, it only finished the day cautiously higher. In the final moments of Friday’s Asia trading session, the Bank of Japan stepped in to tame a yield increase in the 10-year bond spurred by bets that the central bank may adjust policy at July’s rate announcement. This pared Yen gains seen during the early hours of Friday as those less dovish bets cooled.

A LOOK AHEAD – ASIA/PACIFIC SHARES MAY FALL AS YEN RISES

A quiet economic data offering for the beginning of this week places market mood as the key driver for FX. To that end, Asia/Pacific benchmark indexes could echo the weakness seen on Wall Street as information technology suffered. This also opens the door for the Japanese Yen to continue gaining. Meanwhile, the sentiment-linked AUD and NZD could pare gains from Friday’s session.

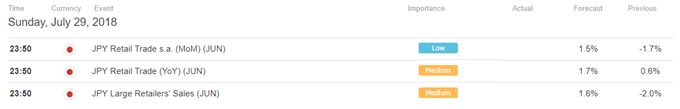

DailyFX Economic Calendar: Asia Pacific (all times in GMT)

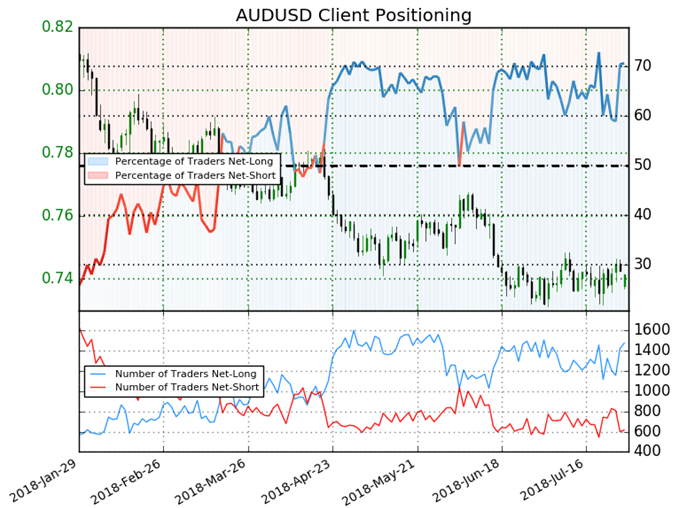

IG Client Sentiment Index Chart of the Day: AUD/USD

Retail trader data shows 70.5% of AUD/USD traders are net-long with the ratio of traders long to short at 2.39 to 1. In fact, traders have remained net-long since Jun 05 when AUD/USD traded near 0.74996; price has moved 1.1% lower since then. The number of traders net-long is 14.4% higher than yesterday and 8.1% higher from last week, while the number of traders net-short is 26.2% lower than yesterday and 0.8% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger AUD/USD-bearish contrarian trading bias.