A Fed that has adopted a less-aggressive stance in lifting borrowing costs has helped to quell a jittery stock market, but arguably few sectors have benefited more from that policy shift than housing shares.

Housing shares are poised for their second-best yearly return of the past seven years, according to FactSet data, even as popular home-building exchange-traded funds were sliding on the day after a barrage of weaker housing data.

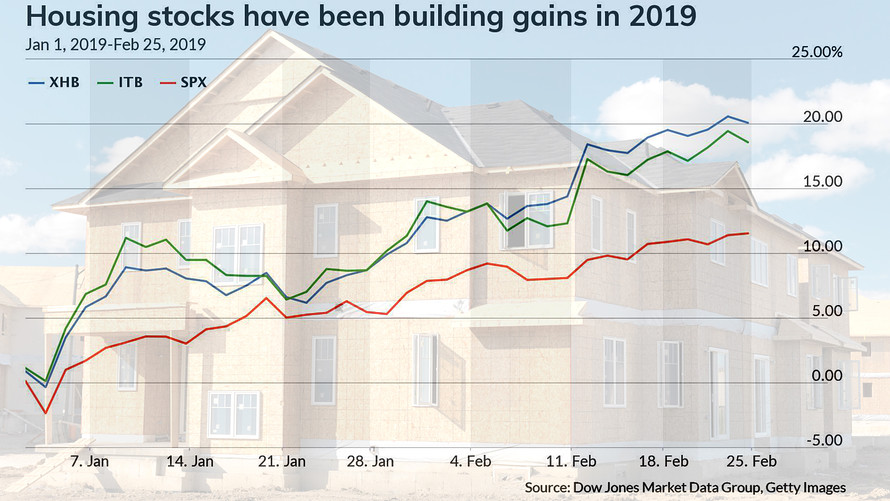

The iShares Home Construction ETF ITB, -0.70% has gained 17.7%, so far in 2019, while the comparable SPDR S&P Homebuilders ETF XHB, -0.54% has returned roughly 19.3%, outstripping 11.6% year-to-date gains for the S&P 500 index SPX, -0.08% and the Dow Jones Industrial Average DJIA, -0.13% which boasts a 12% climb.

Of course, shares of those housing funds were slumping Tuesday, with the iShares ETF and the SPDR fund down by at least 0.6%, after investors were presented with a number of worrying data on the housing sector.

The Commerce Department reported Tuesday that new-home construction declined by 11% to its lowest level since 2016.

On top of that, the Case-Shiller home price index grew by 4.2% in December, below economists expectations, and at the slowest rate since housing prices bottomed in 2012. Meanwhile, housing-sensitive Home Depot Inc. HD, -0.88% announced disappointing fourth-quarter earnings Tuesday that helped to underscore concerns about Americans appetite for real estate and home improvements.

Still, analysts and investors interviewed by MarketWatch, cautioned against overreacting to these data, arguing that the Fed’s recent pivot toward dovish interest-rate policy, the tempered pace of the housing recovery since the financial crisis, and demographic factors would combine to help support the housing market in the long term.

“The housing start number was terrible,” said Michael Antonelli, equity sales trader at R.W. Baird, told MarketWatch. “But the Case-Shiller data is another story.”

“Home prices don’t just go up like a stock,” Antonelli countered. “Even in the horrible economic environment at the end of last year, when economic data was decelerating, home prices still grew at twice the rate of inflation. A reasonable person can’t expect homes to appreciate better than inflation forever.’”

Last year, housing ETFs registered their worst years since the 2008, when global markets buckled under the pressure of a housing implosion. Part of the impetus for last year’s weakness was four rate increases by the Federal Reserve, which was blamed for tightening financial conditions and upending a broad rally in equity markets. However, last month the Fed declared that it would effectively put on hold further interest-rate increases. A Fed rate increase can make borrowing for everything from home mortgages to car loans more expensive.

“Mortgage rates have plummeted from north of 5% in November to 4.3% today, and that is going to have a positive effect on housing,” Antonelli said.

Experts say recent limits placed on the amount state and local taxes Americans are allowed to deduct from their federal taxes each year are impacting recent housing data. George Pearkes, macro strategist with Bespoke Investment Group, estimated in a Tuesday research note that much of the slowdown in home-price appreciation can be attributed to higher property tax burdens as a result of the revisions to tax law in late 2018.

“The average monthly rate of appreciation for home prices in low-tax metros has been 3-5% higher (at annual rates) on average per month relative to high-tax metros,’ Pearkes wrote.

He said, however, that those changes will not have a lasting effect on home prices. “We would also note that the ‘shock’ of tax law changes isn’t permanent and eventually we would expect [home price appreciation in low tax jurisdictions and high-tax jurisdictions] to return to similar rates of growth.”

Meanwhile, Antonelli argued, housing data from December isn’t necessarily useful when analyzing the state of the housing sector today, given that the Fed was still hiking interest rates in the fourth-quarter of last year.

Mat Klody, chief investment officer Keebeck Wealth Management, said home-builder stocks remain attractive because those born between 1980 and 2000, referred to sometimes as millennials, are likely to be active purchasers of homes despite research that has suggested otherwise.

“We are constructive on housing longer term primarily due to millennials starting to come into that prime household formation age,” he said. “That is a five to 15-year tailwind, and there is still pent up demand,” Klody said, in an interview.

“Millennials have been slow to start their own households and buy homes, but the data say that is beginning to change,” he said pointing to data from Realtor.com that show millennials now account for the largest share of new-home loans by dollar volume.

If true, millennial buying would deliver another fillip to home-builder shares, he speculated.