Here at High Dividend Opportunities we could have named ourselves “Making Retirement Possible” but it just wasn’t as catchy. It’s true though, we focus on immediate income investing that unlocks high returns and changes the mindset of investors. We take worried, panicked traders and mold them into relaxed, determined income investors. These investors know their retirement is secure and their future is financially stable, not because their portfolio is so massive they could buy their way out of life’s issues, but because their income is so steady they don’t have to worry about next month’s income needs.

Compare your portfolio to electricity for a moment. Electric current is measured in amperes and voltage. Amperes, or amps, are the flow of electricity. The higher the amps, the greater the flow. Voltage is the pressure of that flow. Think of a waterfall, the higher the amps, the more water flowing over the fall. The higher the voltage, the taller that waterfall is. A small waterfall with tons of water cascading over it or a very tall waterfall with a single drop could hypothetically achieve the same effective damage to a human standing below it.

Watts are the measure of both voltage and amperage together (Watts = Amps x Volts). Watts doesn’t care if voltage or amperage is higher. Twenty watts can be comprised of 2 amps and 10 volts, or 10 amps and 2 volts.

Why talk about electricity? Besides making almost everything operate – like the screen you’re reading this on! It’s a great comparison to retirement portfolios. Watts – the income you need to survive in retirement is equal to your portfolio size – voltage – times your income stream – amperage.

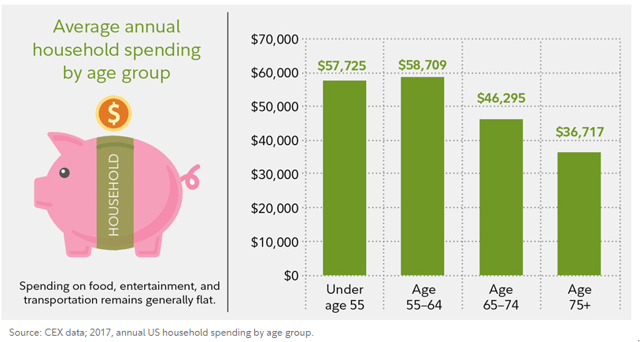

The rule of thumb is a 4% withdrawal from your portfolio is “safe.” This assumes the withdrawal will be comprised of mostly dividends and interest income. Essentially this caps most portfolios’ yield to about 4%. A millionaire 401K would generate a measly $40,000 annually. According to the U.S. Bureau of Labor Statistics, the average American, 65 and over, spends $46,000 annually.

This means you would need your pension, Social Security and other income streams to offset the $6,000 annual difference.

That’s great if you’ve achieved this already. At Fidelity Investments there were only 180,000 of you in the first quarter of 2019. You’re part of a pretty special club.

The rest of us, however, face a starker reality. The average American has $50,000 set aside for retirement. Using our 4% rule from before, you’d generate $2,000 annually on top of Social Security, pensions, etc. It’s no wonder so many Americans are working later in life and struggling to actually retire.

The goalposts move further if you decide to live in parts of the country or world where $46,000 isn’t enough to cover your expenses, or if your past decisions and debt increased your expenses. For every additional $1,000 of annual income needed, you need $25,000 additional portfolio size using the 4% rule.

What can or should the average retiree or near retiree do? Change your perspective on how the equation works.

Stop Focusing on The Voltage

Most retirees have accepted the 4% rule as final. 4% is all the yield you can safely achieve, any more is “high risk” or “gambling.” So they desperately scrape and struggle to save $1 million on the average person’s income. Ironically, these same people are overwhelmingly living paycheck to paycheck with low wage growth. Essentially they’ve been placed on a hamster wheel and told if they run fast enough – they’ll get somewhere. It’s unfair. It’s impossible. It’s downright idiotic. Yet, articles one after another are written about achieving this lofty goal like searching for the Great Carbuncle in the mountains.

We love to compare things as humans: Cars, houses, wages from work and portfolio size. Ironically, like voltage, no matter how big it is, it’s worthless if it doesn’t achieve your goal.

It’s Time to Crank Up the Amperage

You can realistically retire with a 401k millionaire’s income stream by adjusting the equation. We at HDO have a model portfolio yielding 9%-10% annually. We’ve achieved 16% total returns, meaning yes we have capital appreciation on top of our yield. 10% yield means to get $40,000 income annually you only need $400,000 – which while still impressively large is still only 40% of a $1 million portfolio!

Additionally, a higher yield provides you more control to reinvest or cash out your dividends as needed. When you do not need cash, you can reinvest and grow your portfolio’s income, when you do need it, you can use it without having to worry about the current price of your shares.

By transitioning your portfolio from lower-yielding picks or no yield picks to higher-yielding securities you can achieve what otherwise is unachievable. Before our detractors start, we need to remind them that in retirement, your income is king. You need to know your next dividend is coming.

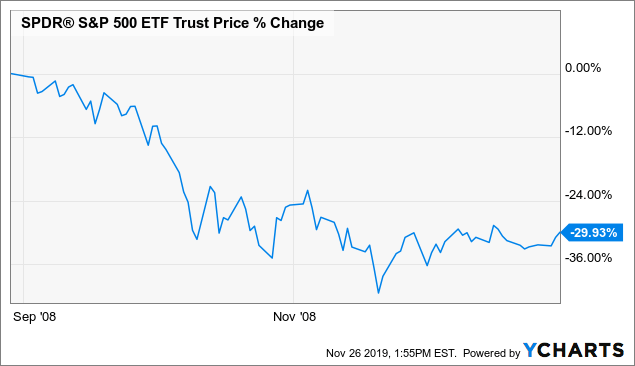

Consider September 2008:

If you had a $1 million portfolio, in just two months you had lost 30% if your portfolio matched SPY. Now you only have $700k. Do you sell and permanently lose that value? You shouldn’t be dependent on selling a security at a premium. When you need the income, the market might or might not be trading at a premium. It’s much better to rely on a group of steady dividend payers. Buy the printing press for the income it prints, not the gem hoping its value improves.

Diversify Your Stream

While thinking about higher-yielding assets, you must maintain a high level of diversity. Often diversification slows the rapid price changes that frighten new investors into selling. It also deadens the impact of one security running away with positive momentum. We’re not traders or momentum investors. We’re income investors wanting that steadily growing income stream.

Currently, we suggest a 35%-40% allocation to high-quality preferreds, bonds, and baby bonds. These often will have a lower yield vs. the rest of your portfolio but work as a bulwark against market volatility. Providing reliable income and fewer ups and downs of price movement.

You should invest across the market sectors: The midstream sector (AMLP), Property REITs, renewable energy, telecom sector, mortgage REITs, utilities sector, and other high yield stocks and sectors. All of these offer unique ways to gain exposure and provide reliable income, all allowing you to retire with a 401k millionaire’s income stream.

Considering buying Steel Partners Holdings L.P., 6.00% Series A Cumulative Preferred Units (SPLP.PA). This preferred stock has the ability to redeem up to 20% of outstanding shares in the first quarter of next year. Locking in income for now and the future while also making about $2 of capital gains per share available for that 20% if you purchased it at today’s prices. While today’s yield is only about 6.5%, its rock steady income stream provided mixed with capital gains potential makes it an excellent pick.

Meanwhile Macerich (MAC) offers up a large 11% yield from an extremely high qualify portfolio of malls. This REIT has to pay out 90% of its taxable income as dividends. Don’t lose sight of the shore when it comes to REITs and dividends. Many very smart bears will highlight random financial terms to distract from a simple understanding – MAC can’t just cut its dividend whenever it wants to whatever they want.

One of our most defensive picks include Annaly Capital (NLY) with a yield of 11%. This is a unique investment opportunity that allows investors to hedge against a possible with a fat yield. This is an 11% yield today, that could double in a recession.

Cut Down the Resistance

Keeping with the electricity theme here, electrical resistance is measured in Ohms. Ohms work in direct relation to Amps, when current passes through a resistor, it reduces the amperage. Debt works on your net income in the same way.

Having high-cost debt, which requires monthly payments to reduce or maintain, will reduce your total net income. Cutting down on debt is one of the only ways to guarantee a 100% return on investment. We’ve highlighted before that the average credit card interest rate is in the high teens, well above any long-term rational portfolio yield.

Want to retire on less savings with high immediate income stocks? Get rid of your high-cost debt.

Key Takeaway

You have one fact to not miss today: You don’t need $1 million in your 401K to retire with $40,000 of recurring safe income.

You can use our Income Method or an immediate income investing style to safely generate the income you need to retire.