AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

Klaviyo Investment Narrative Recap

The core thesis for Klaviyo rests on the belief that it can lead in AI-driven marketing automation while expanding its B2C CRM suite, capturing wallet share from both SMBs and enterprises. The debut of Marketing Agent and Customer Agent supports the catalyst of product innovation but does not materially alter the main risks near term, especially ongoing pressure on gross margins from higher infrastructure and channel costs.

Among recent announcements, July’s launch of Klaviyo Service in public beta, introducing AI-powered real-time customer engagement, directly relates to this week’s agent releases, reinforcing Klaviyo’s bet on AI to increase ARPU and market share, but success remains unproven. Integration of these tools signals further evolution toward unified, seamless experiences for consumer brands.

Yet, against these opportunities, investors should also consider potential headwinds from margin pressure as new channels gain traction and infrastructure costs continue to rise…

Klaviyo’s narrative projects $1.9 billion in revenue and $88.3 million in earnings by 2028. This requires 21.4% yearly revenue growth and a $155 million increase in earnings from -$66.7 million today.

Exploring Other Perspectives

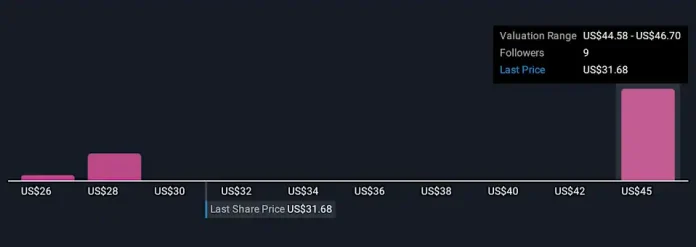

Three Simply Wall St Community fair value estimates for Klaviyo range widely from US$25.52 to US$46.70 per share. While optimism about product innovation prevails, your view may differ sharply based on how you weigh margin pressure and revenue potential.